Weekly Alpha #47 - The Intelligent Investor's Crypto Risk Management Blueprint

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome back to Weekly Alpha — your curated edge in DeFi, tokenomics, and macro shifts before they go mainstream.

In this edition of The Weekly Alpha:

📚 This Week's Intel

🎧 Podcast Picks

🔓 Vesting Watch

🚁 The Intelligent Investor's Crypto Risk Management Blueprint

🧐 Onchain Analytics

🎯 Airdrop Alpha (NEW)

📊 Token Watch (NEW)

🔥 Want to earn yield and front-run a potential airdrop?

Try infiniFi early with my referral link

Your click supports this newsletter and gets you direct access to the protocol before it breaks out.

This Week's Intel 📚

The signal from the noise, this week's developments that actually matter for your DeFi positioning.

I've filtered through the endless stream of headlines, hot takes, and crypto Twitter drama to bring you the stories moving the ecosystem forward. These aren't just news updates; they're intelligence briefings on where capital is flowing, which narratives are gaining traction, and what regulatory shifts could reshape your strategy.

Skip the timeline doom-scrolling. This is your weekly intel drop.

Ethereum Hits New All-Time High Following Russell 2000 and Dow Jones Breakouts

Ethereum hit a new all-time high of $4,845 (with an intraday peak of $4,882) on August 22, gaining over 14% and bringing its 2025 returns to approximately 45%—significantly outpacing Bitcoin's 25% year-to-date gain. The crypto rally coincided with strong equity market performance, as the Dow Jones surged over 800 points (1.9%) to its first record close of 2025, while small-cap stocks led the charge with the Russell 2000 jumping 3.9%. This synchronized rally across crypto and traditional markets was driven by renewed optimism around potential Federal Reserve rate cuts as early as September, following dovish signals from Chair Jerome Powell. The broad-based strength suggests growing institutional appetite for risk assets and renewed confidence in both emerging digital assets and traditional blue-chip sectors.

Read the full blockchainreporter article

Digital Asset Treasury Companies Drive New Wave of Corporate Crypto Holdings

Digital asset treasury companies now control over $100 billion in crypto holdings, with 98 firms raising $43+ billion since June to buy Bitcoin and other tokens. While MicroStrategy leads with $73+ billion in Bitcoin, the trend is expanding beyond BTC, companies are increasingly holding Ethereum, Solana, and emerging altcoins like Sui and Ethena's ENA for yield generation and strategic alignment. This shift represents a fundamental change in corporate treasury management, though volatility and regulatory risks remain key concerns for public companies betting their balance sheets on digital assets.

Read the full The Defiant article

MetaMask adds Google and Apple logins to streamline wallet setup

MetaMask has introduced a new "social login" feature that allows users to create, back up, and restore their crypto wallets using Google or Apple accounts, eliminating the traditional barrier of managing 12-word recovery phrases that have long deterred newcomers to cryptocurrency. Powered by Web3Auth, this update is currently available on browser extensions and will soon expand to mobile, automatically syncing networks, tokens, and accounts across devices to streamline the onboarding process. While this change makes wallet access more user-friendly and familiar, it introduces trade-offs including dependencies on third-party providers and potential privacy and centralization concerns, though users can still maintain traditional recovery phrases as backup to mitigate risks if they lose access to their social accounts.

Hyperliquid Captures 80% of DeFi Derivatives Market with $30B Daily Volume

Hyperliquid has achieved dominance in decentralized perpetuals trading, processing up to $30 billion daily and controlling over 80% market share according to a new RedStone report. The platform's success stems from three key innovations: fully on-chain order books delivering CEX-level performance, HIP-3 permissionless market creation that incentivizes builders with revenue sharing, and a dual-architecture design (HyperCore + HyperEVM) enabling novel financial primitives.

With $2.2 billion TVL and $330 billion in monthly volume, the self-funded exchange demonstrates how technical execution can outcompete venture-backed competitors. The platform's builder-first approach and infrastructure-level positioning suggest it's becoming foundational infrastructure for on-chain finance rather than just another DEX.

Podcast Picks 🎧

This week's audio alpha—handpicked conversations that shaped my thinking and could shift yours too.

I sift through hours of DeFi content so you don't have to. These are the episodes worth your commute, the insights that made me pause and rewind, and the perspectives that are moving markets before they hit mainstream media.

Queue these up and stay ahead of the narrative.

The Rollup: The Truth Behind Story Protocol - listen

Bankless: Will Crypto Peak in 2025… or Run Into 2026? - listen

When Shift Happens: Why Crypto Needs Wall Street to Go Mainstream - listen

Forward Guidance: How to Measure Market Froth & Systemic Risk - listen

The Chopping Block: Robinhood’s Vlad Tenev Claps Back: From Memecoins to Real Assets - listen

Vesting Watch 🔓

Token unlocks to watch this week. Expect potential volatility around these dates as new supply hits the market.

JUP (1.78% of released Supply) - August 28

OP (1.90% of released Supply) - August 31

DYDX (0.59% of released Supply) - September 01

SUI (1.25% of released Supply) - September 01

ENA (0.64% of released Supply) - September 02

The Intelligent Investor's Crypto Risk Management Blueprint

The difference between crypto millionaires and cautionary tales isn't luck or timing, it's risk management.

While everyone focuses on which coins to buy, the real alpha lies in knowing when to sell, how much to risk, and how to survive the inevitable 80% drawdowns. This isn't about playing it safe; it's about playing it smart. The most successful crypto investors aren't the ones who hit every moonshot, but those who consistently compound gains while avoiding catastrophic losses. Here's your blueprint for building generational wealth without losing your shirt.

Portfolio Diversification Never allocate more than 5% of your total portfolio to any single altcoin, regardless of conviction. Spread exposure across blue chips (40%), established DeFi (30%), emerging narratives (20%), and high-risk plays (10%). Remember that crypto correlations approach 0.9 during crashes, so geographic and sector diversification within traditional assets remains crucial.

Profit-Taking Strategies Implement systematic exit rules before euphoria hits: sell 25% at 2x, 50% at 4x, 75% at 10x. Use reverse DCA by taking profits weekly during parabolic moves. Set trailing stops at 30-50% below recent highs to protect gains while allowing for continued upside. The goal isn't to time the top but to ensure you never give back life-changing money.

Safe Harbor Assets Rotate profits into yield-generating stablecoins rather than holding cash. Aave's USDC pools offer 4-8% APY with minimal smart contract risk. Consider Bitcoin as your crypto allocation's defensive anchor, typically 30-50% of total crypto exposure. During bull markets, resist the urge to rotate BTC into alts until you've secured profits elsewhere.

DeFi Risk Management Stick to protocols with $1B+ TVL and multiple audits. Never chase 100%+ APY yields during market euphoria; they signal unsustainable tokenomics. Diversify across 3-5 different protocols to avoid single points of failure. Always keep 20% of DeFi allocation in blue-chip protocols like Aave or Compound as stability anchors.

Psychological Safeguards Create separate wallets: one for long-term holds you never touch, one for trading. Remove your initial investment once positions reach 200-300% gains to eliminate emotional attachment. Set calendar reminders to reassess risk allocation monthly, not daily. Write down your sell targets when sober and stick to them when euphoric.

Market Cycle Awareness Monitor exchange inflows and long-term holder distribution to gauge cycle positioning. When retail FOMO peaks and your barber asks about crypto, begin rotating to safer assets. Maintain 6-12 months of living expenses in traditional savings as your bear market survival fund. Bull markets make you feel like a genius; bear markets reveal who actually had a plan.

Tax-Efficient Strategies Harvest tax losses in December to offset gains. Use FIFO accounting to minimize short-term capital gains where possible. Consider taking profits across multiple tax years to stay within lower brackets. Keep detailed transaction records; the IRS is watching. Remember: paying taxes on crypto gains means you actually made money.

Token Watch 📊

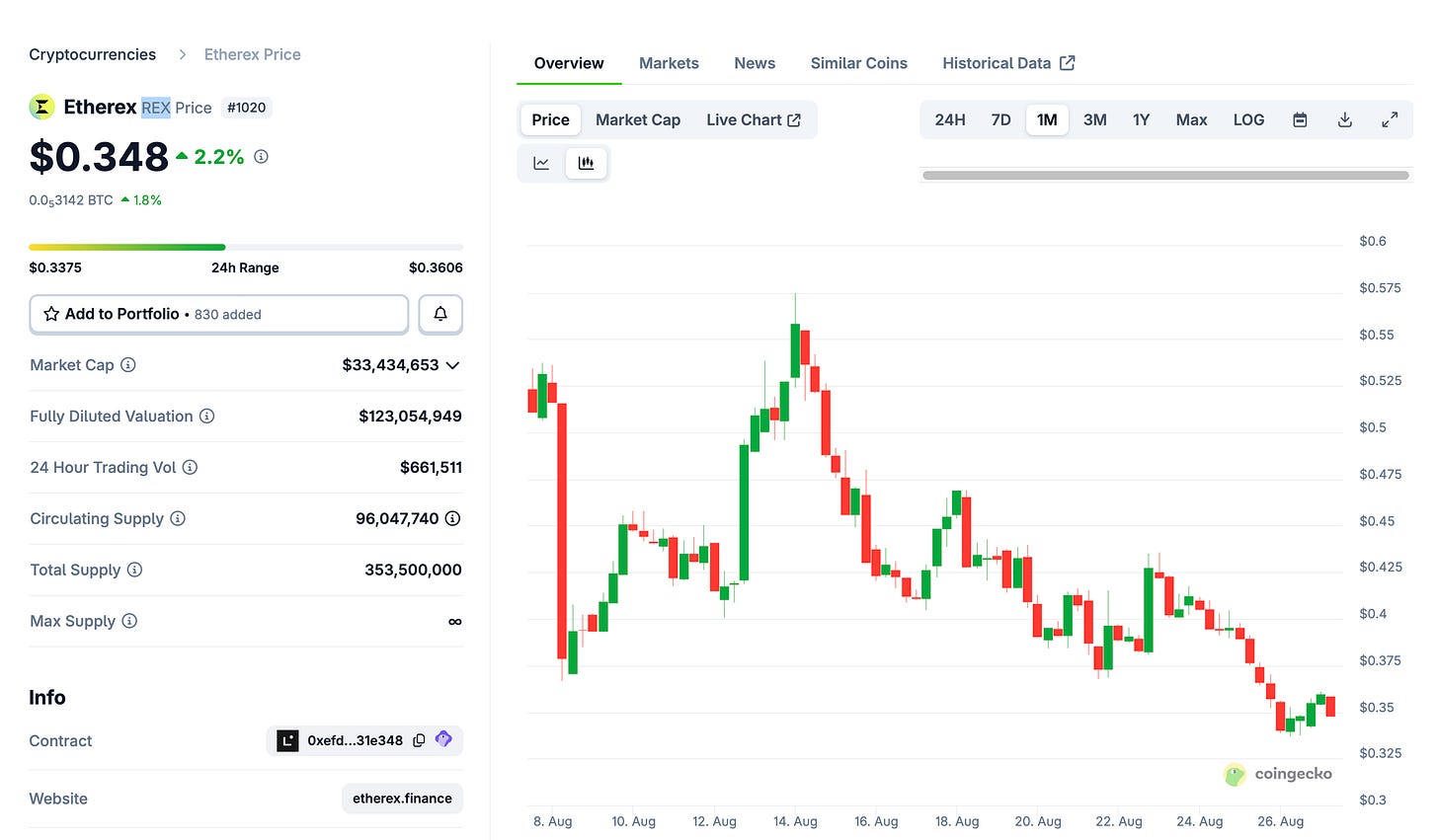

REX Token

Etherex is a decentralized exchange on Linea that launched in late July and has quickly become the #2 protocol by TVL on the network, trailing only Aave. With $177M in TVL and consistent growth.

The protocol has already generated $1.39M in net income for REX token holders since launch.

This looks like bullish mid-term play if Linea continues scaling. We could see similar dynamics to Aerodrome Finance on Base, where the primary DEX captures outsized value as the ecosystem grows. Etherex is positioning itself as Linea's liquidity hub, offering attractive yields like 11% APR on the USDC/USDT stable pair to bootstrap liquidity.

The token currently trades at $0.348 with weak chart action, but the real catalyst is a potential Linea token airdrop. If Linea launches governance tokens and drives user migration to the network, Etherex should capture significant fee flow as the dominant trading venue. You can farm REX tokens by providing liquidity to protocol pools, creating a natural accumulation strategy.

The risk-reward favors holding through a Linea airdrop event. Until then, Etherex offers both yield farming opportunities and exposure to Linea's ecosystem growth.

Airdrop Alpha 🎯

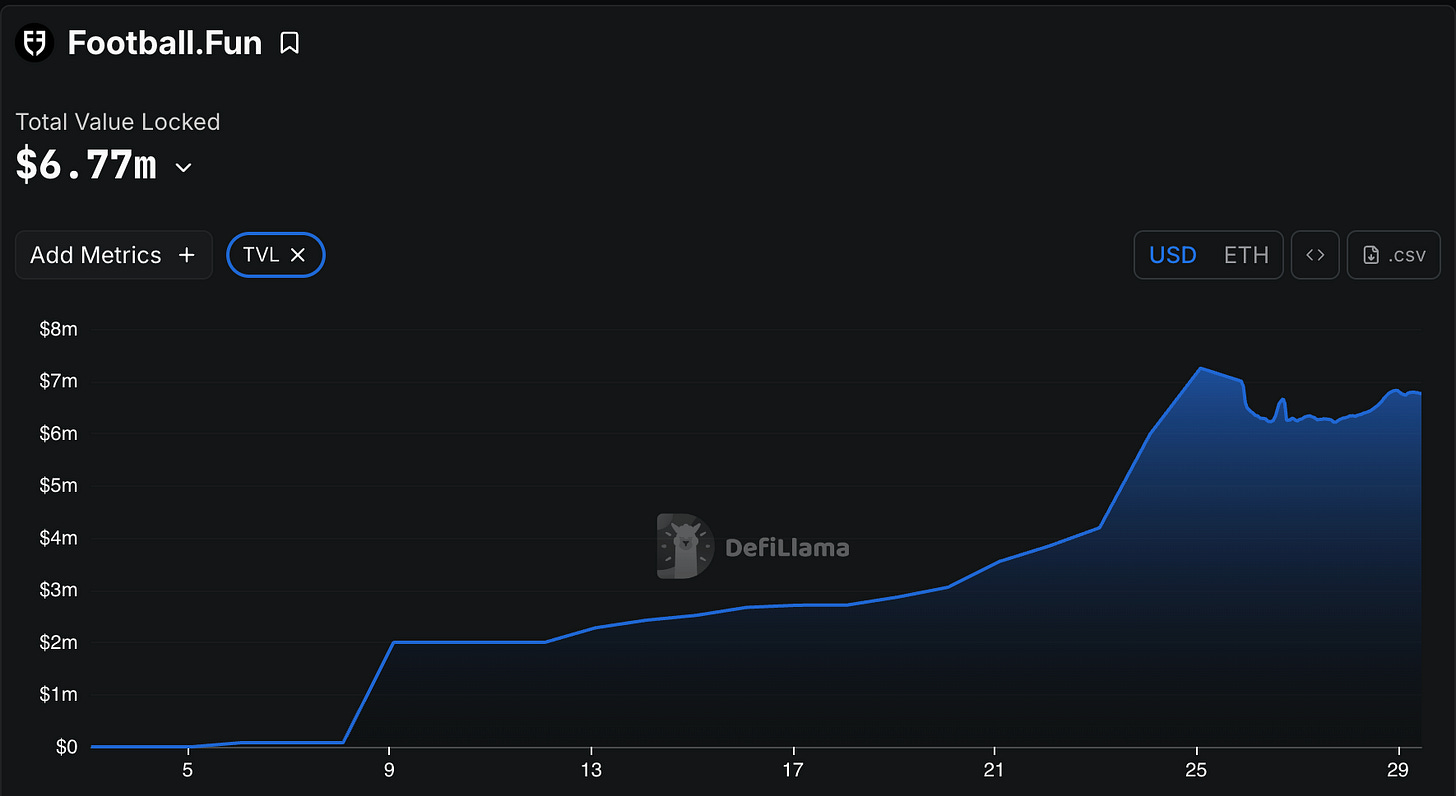

Football.Fun - Fantasy Football Meets Token Trading

Football.Fun combines fantasy football with asset trading mechanics in a free-to-play format. Instead of setting weekly lineups, you collect player shares through pack openings and trade them like tokens based on real-world performance. Players automatically compete in twice-weekly tournaments, earning you Gold rewards when they perform well on the pitch

.

The game operates on three main strategies: passive accumulation of undervalued players, fixture-based trading around favorable matchups, or pure market speculation buying low and selling high. Currently in Gold Rush beta with no deposit required, rewards include physical kits and tokenized squads for the full launch.

Unlike failed platforms like Football Index, this is genuinely free-to-play without real-money gambling mechanics. The sustainable tokenomics and transparent financial model address the issues that killed previous football trading platforms. Early beta participation could position you well for potential airdrops when the platform fully launches with its native token economy.

Worth checking out if you understand football markets and want exposure to a potential gaming token play with actual utility beyond speculation.

How to Play Football.Fun

The core gameplay revolves around pack opening, trading, and passive tournament participation. You start by ripping player packs to build your initial squad, collecting shares in real footballers from Europe's top leagues. Each player has a market value that fluctuates based on real-world form and performance.

Trading happens continuously using Gold as the in-game currency. Buy undervalued players before good fixtures, hold performers during hot streaks, or flip based on market sentiment. Unlike traditional fantasy football, there are no lineups to set. Your entire squad automatically enters twice-weekly tournaments, earning Gold rewards when your players perform well in actual matches.

The strategy layer comes from portfolio management: diversify across leagues and positions, time your trades around fixtures and transfer windows, and balance between holding for tournament rewards versus quick trading profits. Squad value is your main metric, combining individual player valuations with accumulated Gold reserves.

Currently free-to-play during beta, making it a zero-risk way to learn the mechanics and potentially position for future tokenized rewards when the platform launches its full economy.

Airdrop Potential

With $6.77M TVL already locked on Base and significant social media buzz, Football.Fun shows early traction that often precedes major airdrops. The platform is building genuine user engagement and economic activity during its beta phase, creating the foundation for a valuable token distribution event.

Early players who accumulate Gold, build valuable squads, and participate in tournaments are likely establishing on-chain history that could be rewarded when the platform tokenizes. The combination of TVL growth, active trading volume, and user acquisition suggests Football.Fun is serious about building sustainable tokenomics rather than just extracting value.

Getting positioned during the free-to-play beta costs nothing but time, while creating potential upside if the platform follows the typical path from beta to token launch. The Base ecosystem has been rewarding early adopters of quality projects, and Football.Fun's sports-focused niche could capture significant value in the growing GameFi sector.

Worth dedicating some time to build up your profile and squad value before the inevitable transition to paid mechanics and token rewards.

Onchain Analytics 🧐

Ethena's Synthetic Dollar Surge: $12B TVL Explosion Signals USDe Adoption

Ethena has experienced explosive growth in 2025, with TVL rocketing from around $5B in early 2025 to $11.9B currently, representing a near-doubling in just months. The protocol's synthetic dollar USDe has found genuine DeFi-market fit, evidenced by $1.147B in annualized fees flowing through the system. At $405M in annual earnings with zero incentive spending, Ethena demonstrates that sustainable yield can attract capital without requiring token emissions or artificial subsidies. The dramatic TVL acceleration starting around April 2025 suggests institutional adoption of delta-neutral stablecoin strategies has reached an inflection point.

The metrics reveal Ethena's positioning as a serious DeFi primitive rather than a DeFi 2.0 experiment. With $549M in daily trading volume and $146M in liquidity, USDe has achieved the scale necessary for institutional use cases. The protocol trades at roughly 10.6x annual earnings based on its $4.3B market cap, indicating reasonable valuation for a high-growth DeFi protocol. Most tellingly, the $6.6B in outstanding fully diluted valuation against $9.7B fully diluted suggests strong token distribution and community ownership. When a synthetic stablecoin can generate $1.1B in annual fees while maintaining $12B in deposits, it proves that users will pay for yield stability in an otherwise volatile crypto landscape.

Ethereum's Stablecoin Dominance Strengthens as L2s Drive Multi-Chain Growth

Ethereum continues to dominate the stablecoin landscape with approximately $140 billion in supply, representing over half of the total $270 billion market as of August 2024. The network's stablecoin supply has grown consistently from around $60 billion in August 2021, demonstrating sustained demand for digital dollars on the world's largest smart contract platform. This growth occurred despite increased competition from alternative chains, highlighting Ethereum's sticky network effects and deep DeFi liquidity that keeps institutional and retail users anchored to the ecosystem.

The emergence of Ethereum Layer 2’s tells an even more bullish story for the broader Ethereum ecosystem. Arbitrum and Polygon PoS have carved out meaningful stablecoin market share, collectively holding billions in digital dollar supply that complements rather than competes with mainnet Ethereum. Base's rapid ascension in 2024 further validates the L2 thesis, showing that users prefer Ethereum's security guarantees paired with improved transaction costs and speed. When combined, Ethereum mainnet plus its L2 ecosystem likely commands 60-65% of total stablecoin supply, creating a moat that alternative L1s struggle to breach.

The data reveals that while Tron captured significant market share through ultra-low fees, Ethereum's multi-layered architecture is positioning it for long-term dominance. As institutional adoption accelerates and regulatory clarity improves, the security and decentralization trade-offs become more critical than marginal transaction cost savings. The steady growth across Ethereum's L2 ecosystem suggests that scaling solutions are successfully retaining users who might otherwise migrate to competing chains, reinforcing Ethereum's position as the primary infrastructure for the digital dollar economy.

That’s it for this week.

If you found this edition valuable, please consider sharing it with your network — it helps grow our community and keeps the alpha flowing.

Follow me on X

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose

This is so in depth and has a mountain of quality information!

Awsome report