Weekly Alpha #50 - How to Farm the $Base Airdrop (3 Strategies)

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome back to Weekly Alpha — your curated edge in DeFi, tokenomics, and macro shifts before they go mainstream.

In this edition of The Weekly Alpha:

📚 This Week's Intel

🎧 Podcast Picks

🔓 Vesting Watch

🧑🌾 How to Farm the $Base Airdrop (3 Strategies)

🧐 Onchain Analytics

🔥 Want to earn yield and front-run a potential airdrop?

Try infiniFi early with my referral link

Your click supports this newsletter and gets you direct access to the protocol before it breaks out.

This Week's Intel 📚

The signal from the noise, this week's developments that actually matter for your DeFi positioning.

I've filtered through the endless stream of headlines, hot takes, and crypto Twitter drama to bring you the stories moving the ecosystem forward. These aren't just news updates; they're intelligence briefings on where capital is flowing, which narratives are gaining traction, and what regulatory shifts could reshape your strategy.

Skip the timeline doom-scrolling. This is your weekly intel drop.

Stablecoins Are Set to Transform Global Payments: EY-Parthenon

A new EY-Parthenon survey reveals stablecoins are rapidly gaining traction in global finance, with 13% of financial institutions and corporations already using them and over half of non-users planning adoption within 6-12 months. The report projects that by 2030, stablecoins will handle 5-10% of cross-border payments—worth $2.1-4.2 trillion. Current users are already seeing tangible benefits, with 41% reporting cost savings of at least 10%. While infrastructure integration remains a challenge (only 8% of corporates currently accept stablecoins), momentum is building with 80% of non-users actively exploring adoption. The recent passage of the GENIUS Act has provided regulatory clarity that's expected to accelerate growth, contributing to the stablecoin market's impressive 69% year-over-year increase to nearly $291 billion in total market cap.

Yala’s YU stablecoin fails to restore peg after ‘attempted attack’

Yala's Bitcoin-collateralized stablecoin YU crashed to as low as $0.2046 following an "attempted protocol attack" on Sunday, failing to recover its $1 peg despite team assurances that all funds remain safe. According to blockchain analytics firm Lookonchain, the attacker exploited the protocol by minting 120 million YU tokens on Polygon, then bridging and selling 7.71 million YU for 7.7 million USDC across Ethereum and Solana networks. The attacker converted the proceeds into 1,501 ETH and still holds significant YU positions across multiple chains. While Yala has paused Convert and Bridge features as a precaution and is investigating with security firm SlowMist, YU continues trading around $0.79—well below its intended dollar peg. The incident highlights ongoing stability challenges for newer stablecoins, even as the broader stablecoin market approaches the $300 billion milestone driven primarily by established players like Tether and USDC.

Read the full Cointelegraph article

Other news

Bitcoin price $150K target comes as analyst sees weeks to all-time highs- read

EigenCloud Surges 25% After Partnering with Google to Boost Trust in AI Payments - read

Ethereum Fusaka upgrade set for December 3 launch - read

France goes rogue, Bitcoin pumps on Fed rate cut: Global Express - read

Trump-backed World Liberty votes for token buybacks and burns - read

TWT Soars Nearly 40% as Trust Wallet Reveals Plans to Add 100X Perps, Prediction Markets - read

Titan raises $7M seed round alongside public launch of meta-DEX aggregator - read

Podcast Picks 🎧

This week's audio alpha—handpicked conversations that shaped my thinking and could shift yours too.

I sift through hours of DeFi content so you don't have to. These are the episodes worth your commute, the insights that made me pause and rewind, and the perspectives that are moving markets before they hit mainstream media.

Queue these up and stay ahead of the narrative.

The Rollup: Pantera, GSR, Pump Science, AI Supercycle EP 1 - listen

Bankless: FinTech Meets Crypto: The Future of Global Payments - listen

Forward Guidance: Winners & Losers After The Fed’s Dovish Pivot - listen

The Chopping Block: Why Every Chain Suddenly Wants Its OWN Stablecoin - listen

Shawn Ryan Show: Brian Armstrong - Mining 21 Million Bitcoins, Satoshi Nakamoto and Elizabeth Warren - listen

Vesting Watch 🔓

Token unlocks to watch this week. Expect potential volatility around these dates as new supply hits the market.

Moca (0.06% of released Supply) – September 26

TRIBL (1.96% of released Supply) – September 26

FET (1.72% of released Supply) – September 17

OP (1.74% of released Supply) – September 30

How to Farm the $Base Airdrop (3 Strategies)

Base creator Jesse Pollak recently revealed the project is "beginning to explore" launching a network token, sparking massive speculation about a potential airdrop. Given Base's position as one of Ethereum's most successful L2s, backed by Coinbase's resources and user base, this could be one of the largest airdrops in crypto history.

With Base hosting major protocols like Aerodrome and Compound, early users are positioning themselves now. Here are 3 strategic moves to maximize your potential allocation without requiring significant capital or complex farming strategies.

Farcaster

Farcaster is a decentralized social network (think X/Twitter) built natively on Base. Every action like posting, using mini-apps, and token swaps generates on-chain transactions that could count toward a Base airdrop. Most interactions are free, making it a low-risk farming opportunity.

The bonus? Farcaster doesn't have its own token yet, meaning active users could potentially qualify for two airdrops: Base and Farcaster.

Strategy: Post consistently (aim for daily), engage with other users, and experiment with Farcaster's built-in features like Frames (interactive posts) and mini-apps. Quality matters more than quantity since authentic engagement typically performs better for airdrops than obvious farming.

Follow me on Farcaster and let's grow together on the platform.

Aerodrome Finance

I discovered Aerodrome Finance through their airdrop to Velodrome (VELO) token holders, and it's become my main Base farming strategy.

Aerodrome serves as Base's primary liquidity hub and ranks among the top 3 DeFi protocols by TVL, alongside Morpho and AAVE. This central position in Base's ecosystem makes it a strategic choice for potential airdrop qualification.

My approach: I've locked my AERO tokens for the maximum 4-year period and vote in every epoch. This demonstrates long-term commitment to the network, which protocols typically reward heavily in airdrops. I focus my votes on high-value pools like cbBTC, earning weekly rewards while staying aligned with Base's growth.

The strategy kills two birds with one stone: generate consistent yield from voting rewards while positioning for both Aerodrome and Base airdrops through active participation.

Morpho Lending

Morpho has become Base's fastest-growing DeFi protocol and maintains deep alignment with the ecosystem. The integration with Coinbase's lending services signals strong institutional backing, making it a prime candidate for Base airdrop eligibility.

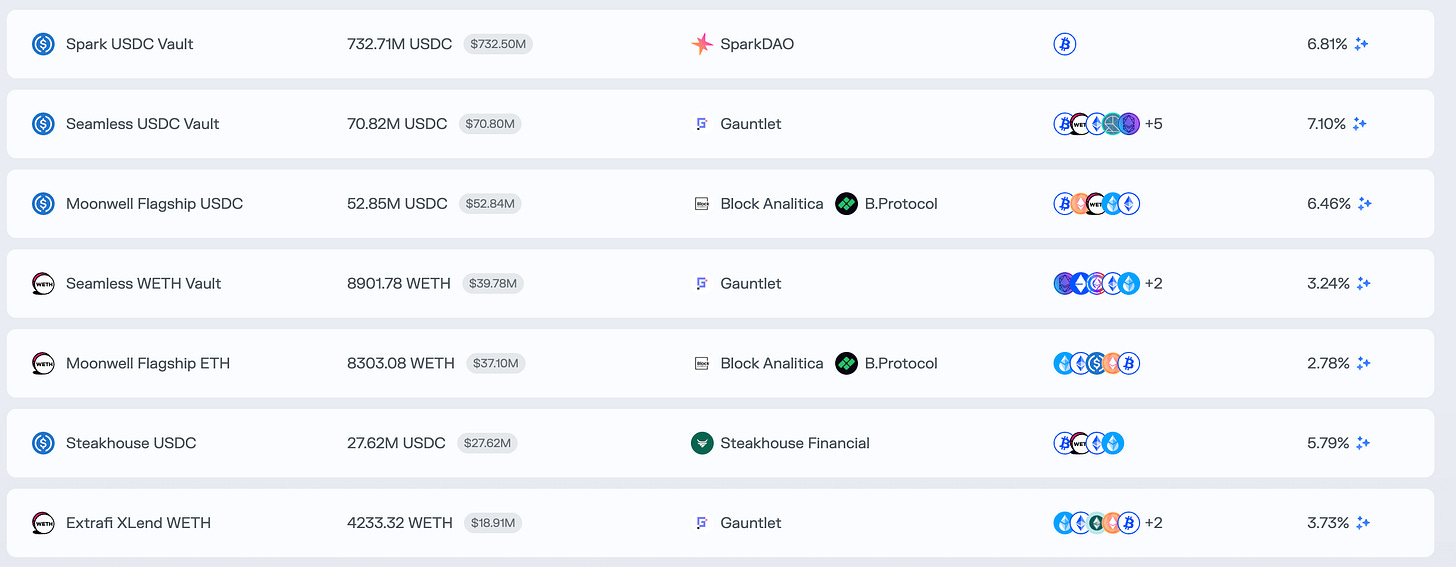

Morpho operates as a lending optimizer that enhances yields on platforms like AAVE and Compound, while offering additional reward incentives. On Base, I'm focusing on established vaults like Spark USDC, which provide competitive yields plus potential boost rewards.

My strategy: Deposit stablecoins into high-TVL Morpho vaults on Base and maintain consistent positions. The protocol's rapid growth and Coinbase partnership suggest that early Base users could see significant airdrop allocations.

Risk consideration: Like all DeFi protocols, smart contract risks exist. Always review vault parameters, underlying strategies, and risk factors before depositing. Start small and scale up as you become comfortable with the platform.eFi protocols.

Final Thought: Quality Over Quantity

The key to any successful airdrop strategy is authentic usage. Base, like most modern protocols, employs sophisticated sybil resistance mechanisms that can easily detect and disqualify obvious farming behavior across multiple wallets.

My approach: I concentrate all activity in one primary wallet to demonstrate genuine engagement rather than diluting interactions across multiple addresses. This creates a clear onchain profile of consistent, meaningful usage that airdrop algorithms typically reward.

Remember, airdrops should be a bonus, not the primary goal. I'm focused on long-term DeFi portfolio growth through these protocols, the potential token rewards are just upside. By choosing Base-aligned protocols like Aerodrome and Morpho, you're naturally positioning yourself while building real value.

Bottom line: Use the network genuinely, consolidate your activity, and focus on protocols with strong Base ties. Authentic users with concentrated, consistent activity typically fare much better than scattered farmers when airdrops arrive.

Onchain Analytics 🧐

Base's Transaction Supremacy: The L2 Volume King Eyes Historic Airdrop

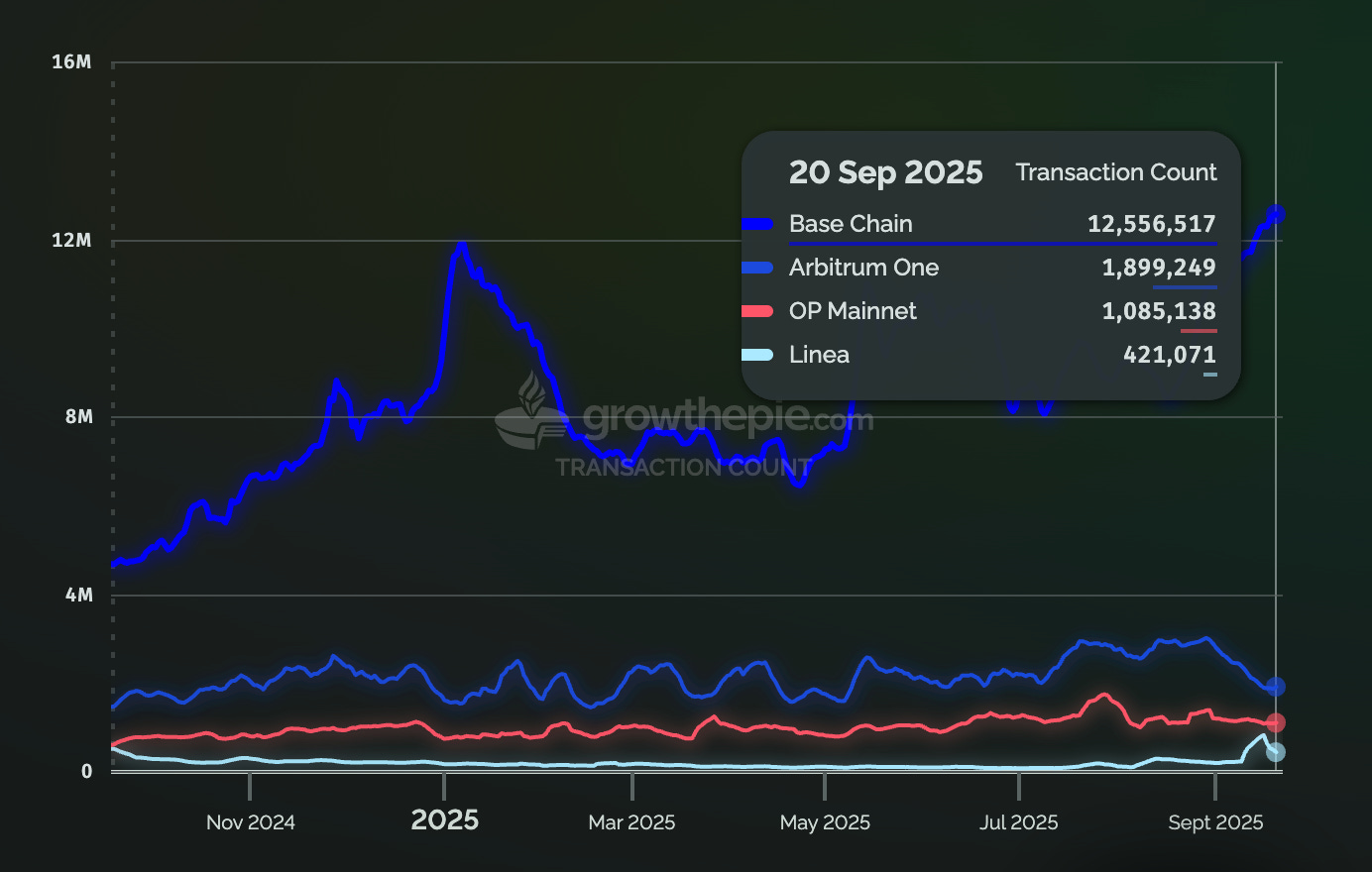

Base has achieved something remarkable in the Layer 2 landscape: absolute transaction dominance with 12.5 million daily transactions as of September 20, 2025. This represents a staggering 6.6x advantage over its nearest competitor Arbitrum One (1.9M), and an 11.5x lead over OP Mainnet (1.1M). When a single L2 processes more transactions than the next three competitors combined, we're witnessing network effect acceleration in real-time.

The transaction volume trajectory tells the story of organic adoption rather than artificial incentivization. Base's steady climb from sub-1M daily transactions in late 2024 to current peaks above 12M demonstrates sustainable user behavior patterns. Unlike wash trading or bot-driven volume spikes common across other chains, Base's transaction growth correlates directly with actual utility—stablecoin transfers, DeFi interactions, and onchain commerce.

The $BASE Token Bombshell: September 15th Changes Everything

On September 15, 2025, Jesse Pollak confirmed that a BASE token is under consideration, noting that Coinbase is exploring a network token as a potential tool to help build the next-generation onchain economy. This announcement represents a seismic shift from Coinbase's previous "no token" stance and signals the most anticipated airdrop in crypto history.

At BaseCamp 2025 in Stowe, Vermont, Base creator Jesse Pollak said the project is "beginning to explore" the launch of a network token, marking a reversal from Coinbase's long-held position that no token was planned. The timing isn't coincidental, with Base processing 12.5M daily transactions, a token launch would reward the largest active user base in L2 history.

The potential airdrop scope is unprecedented. While previous L2 airdrops distributed tokens to thousands of users, Base's massive transaction volume suggests hundreds of thousands of eligible addresses. Early estimates indicate this could be the largest crypto airdrop by both recipient count and total value distribution.

That’s it for this week.

If you found this edition valuable, please consider sharing it with your network — it helps grow our community and keeps the alpha flowing.

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose