Weekly Alpha #48 - 3 Airdrops to farm on Hyperliquid

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome back to Weekly Alpha — your curated edge in DeFi, tokenomics, and macro shifts before they go mainstream.

In this edition of The Weekly Alpha:

📚 This Week's Intel

🎧 Podcast Picks

🔓 Vesting Watch

🚁 3 Airdrops to farm on Hyperliquid

🧐 Onchain Analytics

📊 Token Watch (NEW)

🔥 Want to earn yield and front-run a potential airdrop?

Try infiniFi early with my referral link

Your click supports this newsletter and gets you direct access to the protocol before it breaks out.

This Week's Intel 📚

The signal from the noise, this week's developments that actually matter for your DeFi positioning.

I've filtered through the endless stream of headlines, hot takes, and crypto Twitter drama to bring you the stories moving the ecosystem forward. These aren't just news updates; they're intelligence briefings on where capital is flowing, which narratives are gaining traction, and what regulatory shifts could reshape your strategy.

Skip the timeline doom-scrolling. This is your weekly intel drop.

EF Outlines L2 Interop Layer to Make Ethereum ‘Feel Like One Chain Again’

The Ethereum Foundation announced a new initiative called the Ethereum Interoperability Layer (EIL) on August 29, aimed at making the fragmented Ethereum ecosystem feel like a unified blockchain again. The EIL will enable seamless cross-Layer 2 transactions while maintaining Ethereum's core principles of censorship resistance, privacy, and security. Currently, users face a 3.5-day waiting period when withdrawing funds from Layer 2 chains like Base or Optimism back to Ethereum mainnet. The foundation is also researching ways to reduce Ethereum's finality time from the current 13-19 minutes down to seconds, and plans to publish a design document for the new layer in October. This effort aligns with Vitalik Buterin's recent proposals for faster withdrawals using zero-knowledge proofs and other advanced technologies.

Read the full the Defiant article

Justin Sun blacklisted after a brutal drop of WLFI token

The WLFI token crashed 61% shortly after launch, tumbling from $0.47 to $0.18. Justin Sun, a key early investor and political ally of Trump’s digital asset push, found his address blacklisted, freezing nearly $600 million worth of unlocked tokens. While WLFI officials hint at manipulation, Sun insists his transactions were harmless technical tests. The dispute has escalated into a wider battle of narratives across the crypto community, leaving retail investors with heavy losses while Sun’s large locked position remains intact.

Read the full Cointribune article

Other news

Hyperliquid Could Launch USDH Stablecoin in Next Network Upgrade - read

Euro stablecoin push runs into thin liquidity - read

7 largest Ether treasury companies right now ranked by holdings - read

ARK Invest Snaps Up $23.5M in BitMine - read

Ethereum Foundation to Unload Another 10K ETH - read

Podcast Picks 🎧

This week's audio alpha—handpicked conversations that shaped my thinking and could shift yours too.

I sift through hours of DeFi content so you don't have to. These are the episodes worth your commute, the insights that made me pause and rewind, and the perspectives that are moving markets before they hit mainstream media.

Queue these up and stay ahead of the narrative.

The Rollup: The Truth Behind Story Protocol - listen

Bankless: ETH Hits All Time High, But Will It Stick? - listen

Forward Guidance: Gold is the Only Trade Left - listen

Empire: Are DATs Sustainable, Stripe Launches Tempo & WLFI’s Token Launch - listen

The Chopping Block: Garbage Moat or Next Big Thing? WLFI Breakdown - listen

Vesting Watch 🔓

Token unlocks to watch this week. Expect potential volatility around these dates as new supply hits the market.

MOVE (1.89% of released Supply) – September 09

AXS (0.25% of released Supply) – September 09

APT (2.20% of released Supply) – September 11

MOCA (0.06% of released Supply) – September 12

STRK (5.98% of released Supply) – September 15

5 Airdrops to farm on Hyperliquid

Hyperliquid is one of the fastest-growing protocols right now, and I don't think the airdrop meta is dead - even though it's evolved significantly over the past few years.

With more airdrop farmers entering the space, increased liquidity requirements, and stronger sybil resistance mechanisms, it's become crucial to position your capital strategically in legitimate, high-potential projects rather than just farming everything.

Kinetiq is a non-custodial liquid staking protocol built on Hyperliquid L1. Users can stake their HYPE tokens and receive kHYPE in return - a liquid, yield-bearing token that represents their staked position while remaining fully composable across DeFi protocols.

Playbook:

Stake your HYPE tokens to receive kHYPE

Earn 2.22% APY on your staked position

Accumulate Kinetiq points for potential future rewards

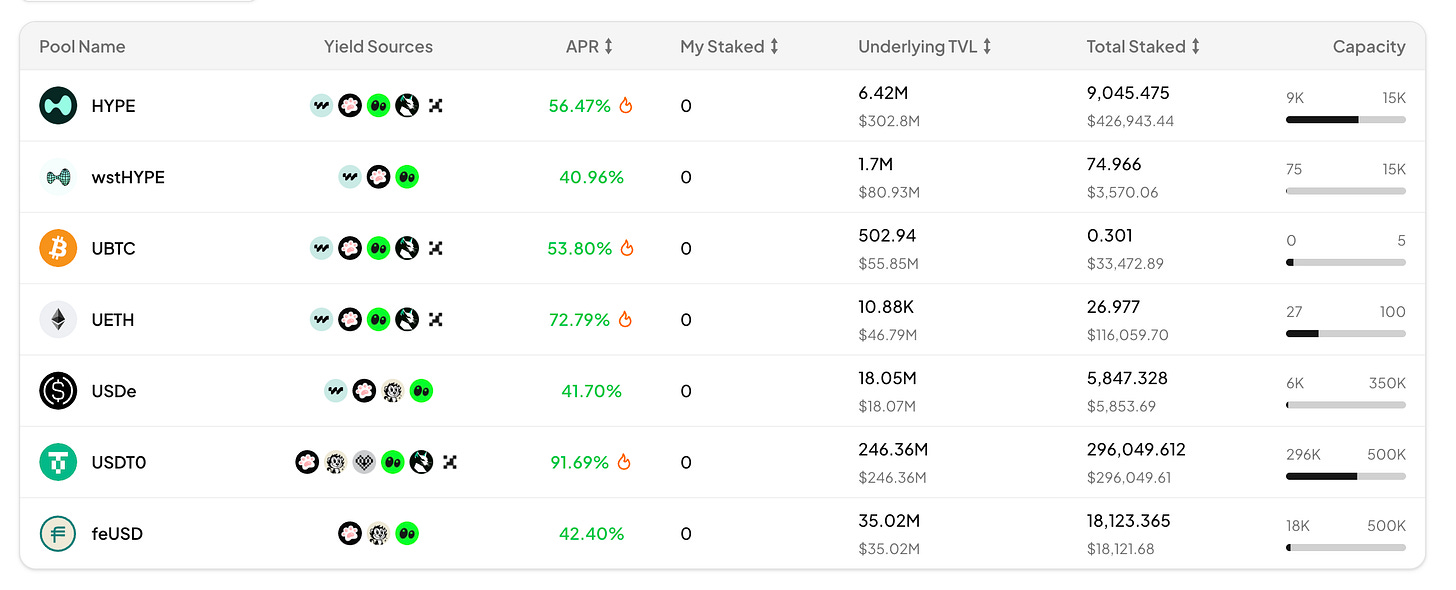

Hypervault Finance is a multichain yield optimization platform that automatically maximizes returns for users

Playbook:

Deposit into any available vault to start earning yield

Accumulate points automatically as you earn

Climb the leaderboard for potential airdrop rewards

An enhanced automated market maker (AMM) built on Elastic's parameterized limit order book technology.

Playbook:

Swap tokens on Hyperliquid DEX to generate trading volume

Provide liquidity to HyperVM pools to earn fees and points

Focus on major pairs for better rewards and lower impermanent loss risk

Token Watch 📊

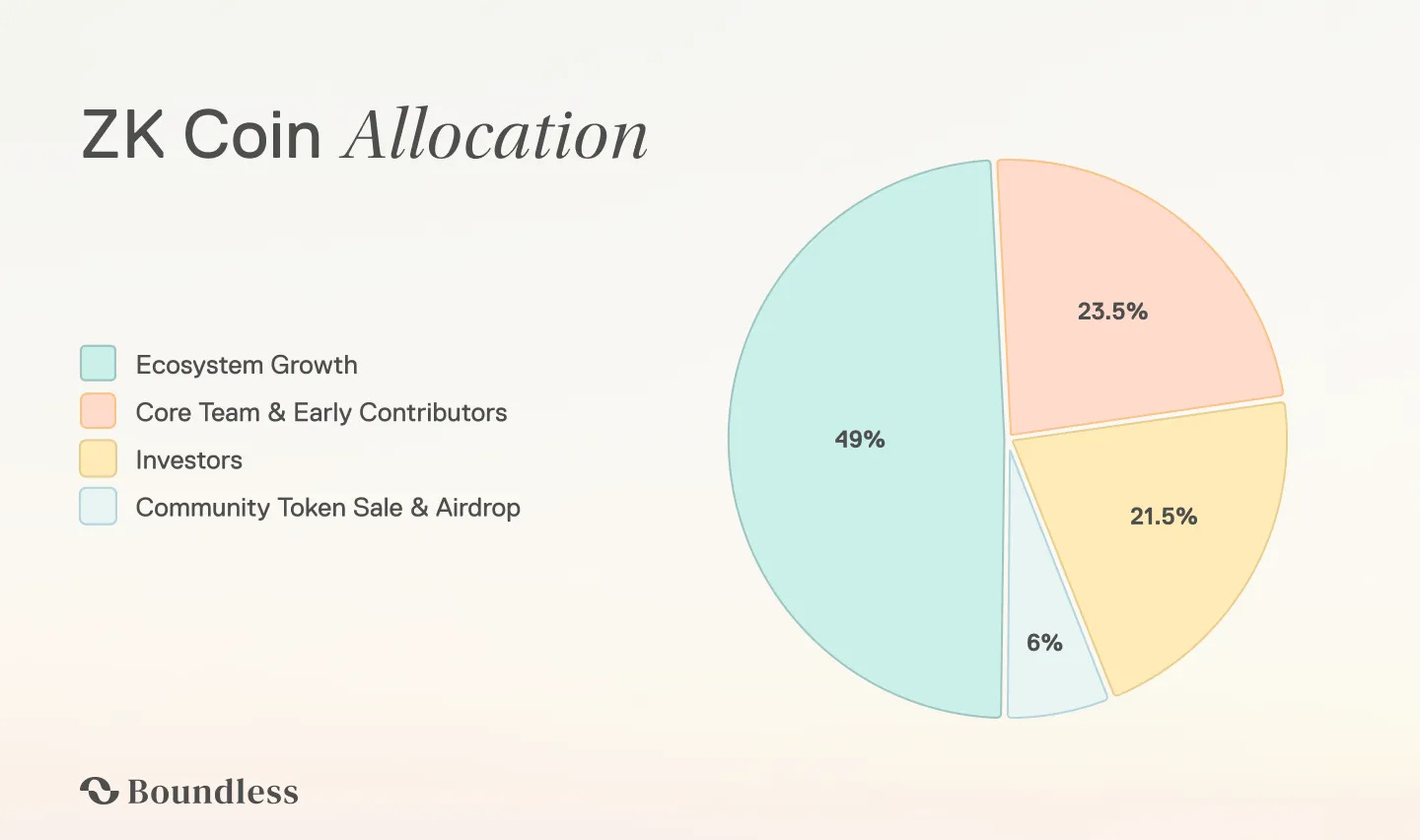

Boundless (ZK Coin)

Boundless hasn't launched yet, but I'm bullish on their potential given the ZK infrastructure they're building for Ethereum and other chains. The universal proving network could become critical infrastructure as more protocols need ZK computation.

The Kaito launchpad for Boundless pre-TGE has already closed, which required KYC verification anyway. I'm personally skeptical about sharing identity documents across multiple platforms, so I'll wait for the TGE and pick up tokens on DEXs instead. Sometimes patience pays off with better entry points anyway.

What is Boundless?

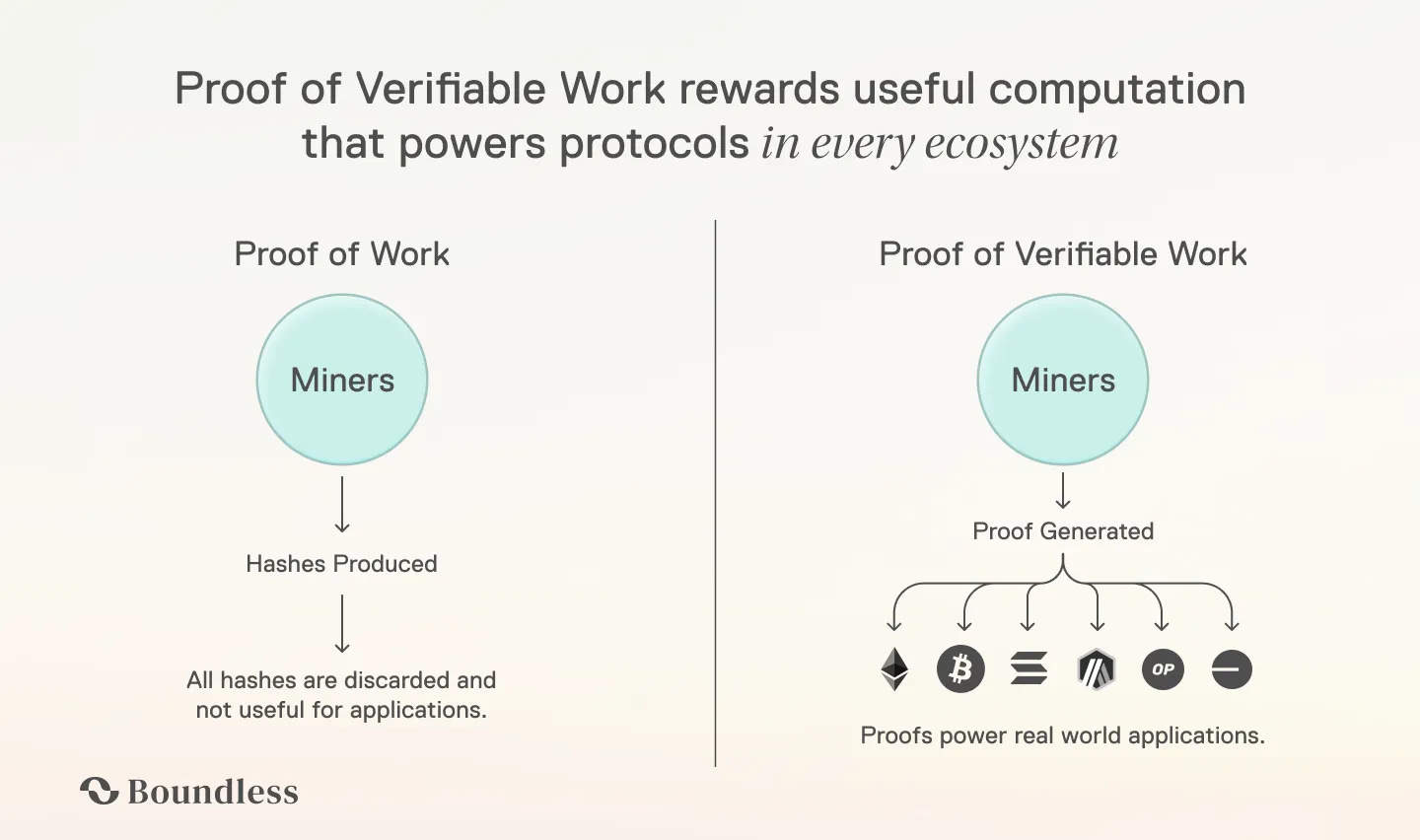

Boundless is a universal ZK proof generation protocol that allows independent prover nodes to generate zero-knowledge proofs for any blockchain, rollup, or application without requiring changes to existing networks.

What is ZK Coin?

ZK Coin (ZKC) is the native token that secures the Boundless network by requiring provers to stake it as collateral before generating proofs, with more ZKC locked as network usage grows and slashed stakes burned to reduce supply.

Onchain Analytics 🧐

Tether's $5B Fee Dominance: The Stablecoin Infrastructure War Is Over (for now)

Tether has cemented its position as the undisputed king of stablecoin infrastructure, generating $5.0B in fees over the past 365 days and capturing 64.5% of total stablecoin fee revenue. This represents one of the most dominant positions in all of crypto, with Tether processing more fee volume than most major blockchains. Circle follows as a distant second with $2.0B in fees (25.5% market share), while the remaining 90% of market participants fight for scraps with Ethena ($378M), Sky ($364.7M), and Usual ($26.7M) rounding out the top five.

The fee metrics reveal Tether's transition from controversial early mover to essential crypto infrastructure. At $5B in annual fees, Tether likely generates more revenue than most Fortune 500 companies while operating with minimal overhead. The 64.5% market dominance suggests network effects have kicked in, where users choose Tether not just for stability but for liquidity and universal acceptance across exchanges and protocols. Unlike the blockchain wars where multiple chains can coexist, stablecoins exhibit winner-take-most dynamics since users prioritize liquidity depth and merchant acceptance over technical features. When institutions and retail users collectively generate $7.8B in total stablecoin fees annually, it demonstrates that crypto has found genuine utility in payments and treasury management, with Tether capturing the lion's share of this value creation.

Ethereum Stablecoins Hit $153.6B All-Time High: The Digital Dollar Infrastructure Reaches Maturity

Ethereum stablecoins have reached a historic $153.6 billion market cap, surging +$3.649B (+2.43%) over the past week to establish a new all-time high. This milestone represents more than just numbers—it signals that Ethereum has become the primary settlement layer for digital dollars, processing more stablecoin value than most national economies. USDT's commanding 48.92% dominance demonstrates that despite regulatory uncertainties, users prioritize liquidity and universal acceptance over technical features, with the market consolidating around proven infrastructure rather than fragmenting across competitors.

The sustained growth from under $30B in 2020 to today's $153.6B peak reflects institutional adoption moving beyond speculation into genuine economic utility. At this scale, Ethereum stablecoins have achieved the liquidity depth necessary for large institutional operations, creating self-reinforcing network effects where increased adoption drives better liquidity, attracting even more institutional users. The 2.43% weekly growth indicates healthy, sustained demand from businesses using stablecoins for cross-border payments, DeFi protocols, and treasury management—proving that crypto has found its killer app in reimagining how digital dollars move through the global financial system.

That’s it for this week.

If you found this edition valuable, please consider sharing it with your network — it helps grow our community and keeps the alpha flowing.

Follow me on X

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose