Weekly Alpha #44 – The Rise of Zora: Redefining the Creator Economy

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome back to Weekly Alpha — your curated edge in DeFi, tokenomics, and macro shifts before they go mainstream.

In this edition of The Weekly Alpha:

📸 The Rise of Zora: Redefining the Creator Economy

🧐 Onchain Analytics

📚 What I’m reading this week

🎧 What I’m listening this week

🔓 Token Unlocks

The Raise Of Zora And The Creator Economy

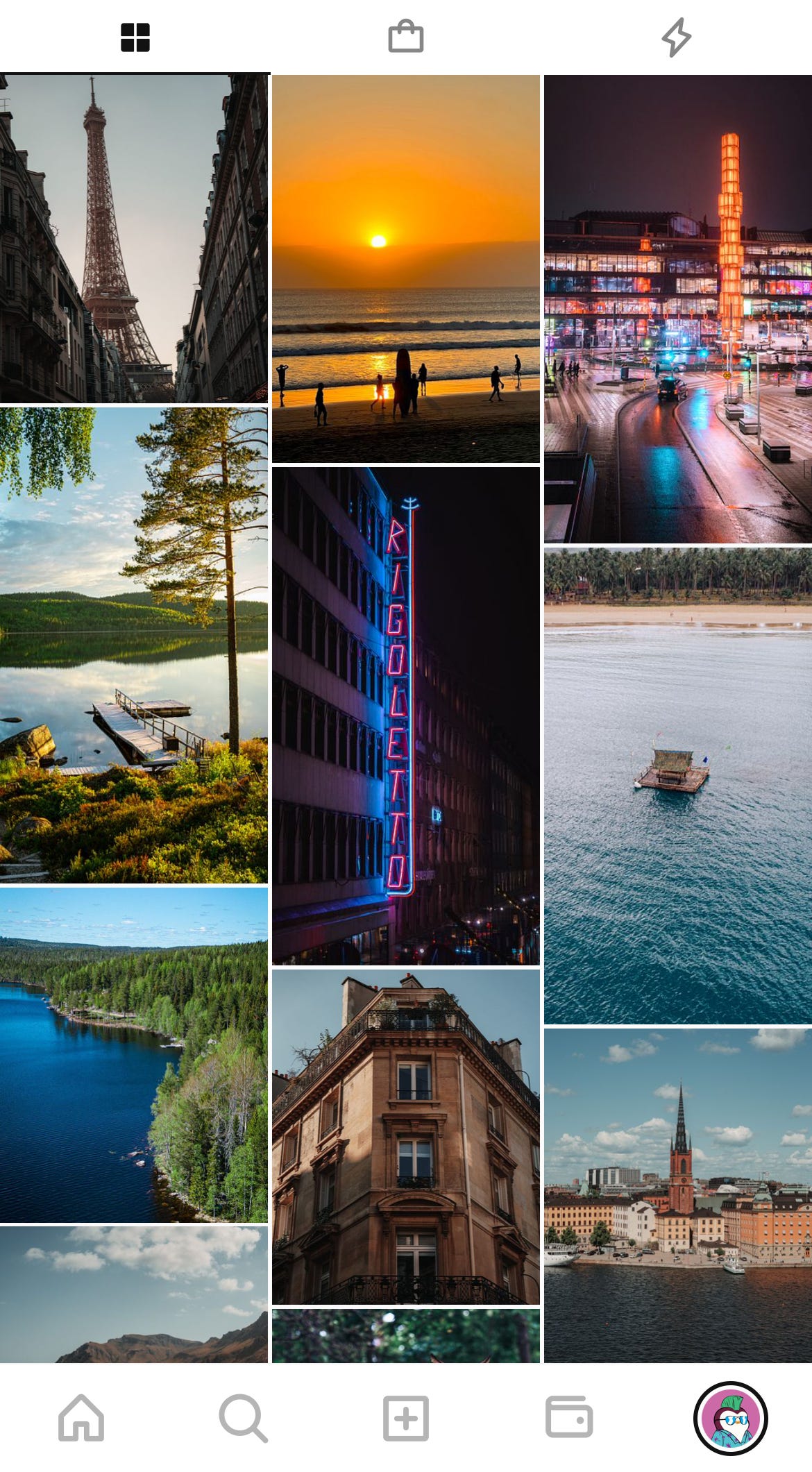

Over the past few weeks, I’ve spent a substantial amount of time using Zora, a new mobile app. If you haven’t heard of it, Zora is a social platform similar to Instagram, but with integrated crypto features.

The app rewards creators, is well-designed, and is genuinely fun to use. In this article, I’ll share my honest opinion on Zora—and whether or not it’s worth onboarding yourself to the platform.

My experience with Zora

I didn’t start using Zora because of the hype—I’ve been following the team for a long time. Over the past few years, they’ve gone through countless iterations, constantly refining their vision. What started as an experiment with physical goods on Uniswap evolved into NFT auctions, redeemable drops, timed editions, and eventually a full social platform layered with crypto primitives.

They’ve shifted from marketplace-style UX to a social UX, moved to their own L2 before others were live, integrated secondary markets, and most recently, doubled down on ERC20 creator coins—tying posts, people, and tokens together in one symbiotic ecosystem. It finally feels like all the pieces are coming together, and they’re gaining real traction.

Zora’s Onboarding Experience

The onboarding process on Zora is incredibly smooth. You create an account using Privy, which means no complex key management is required—just your email address. Once you're in, you can start posting photos and videos right away, similar to how you would on Instagram.

Trading Zora content

The moment you post content, it instantly becomes tradable. That means by simply sharing on Zora, you can start earning money, investing in other creators' content, and selling your holdings. Each piece of content becomes a token—not an NFT, but an ERC-20 token—so you're able to sell just a portion of your holdings if you want.

This model means I don’t need a massive following to earn a few bucks on Zora. The app is thoughtfully designed and easy to use. For example, double-tapping on a post in your feed doesn’t just "like" it—it actually buys a piece of the content. You can later resell it at a profit or a loss, just like any other token.

My only issue with the platform is that everyone tends to rush toward big creators—especially those with large followings on X. That makes total sense, of course, but it would be great to have a better discovery flow to help smaller creators grow on the platform. Even though the team is clearly working hard on it, I think there’s still room for improvement.

Creator Coins on Zora

One of the coolest features on Zora is the ability to launch your own creator coin. Once enabled, other users can start investing in you directly on the platform. What makes this powerful is that beyond just posting photos, there’s now a real financial incentive for creators to consistently share content and get their voices heard.

In my opinion, the simplicity of the onboarding process—creating a coin takes just a few taps—and the fact that it’s instantly tradable could be a major draw for non-crypto-native users. It makes it easy for creators to move their communities from platforms like Instagram to Zora, where the incentives are much stronger.

Every time someone trades your creator coin, you earn a fee paid in $ZORA, the platform’s native token. Those fees can be reinvested into other content, used to buy back your own coin, or simply withdrawn. Some top creators are earning hundreds of thousands of dollars in fees—similar to liquidity providers on Uniswap. And that’s no coincidence—Zora is built on top of Uniswap, tapping into the power of DeFi composability.

Affiliate Rewards on Zora

Zora also lets you invite users to the platform through an affiliate system. If someone you invite becomes an active trader, you earn a portion of the fees they generate. It’s a smart incentive that encourages users to bring their friends and communities onto the app—further fueling organic growth.

Final Thoughts

After spending a few weeks on Zora, my experience has been overwhelmingly positive—not because of the financial incentives, but because it aligns perfectly with the things I love: creating content, DeFi, and photography. For me, it’s the ideal creator platform. I don’t need sponsors to start earning from my creativity; all I need is my community and the willingness to share what I enjoy—just like I would on Instagram.

What makes Zora so exciting is that it gives me a place to combine both of my passions—photography and DeFi—into a single experience. That’s why I’m genuinely enthusiastic about where this platform is headed.

Have you tried Zora yet? If so, I’d love to hear about your experience. If not, feel free to use my invite link to support my work. It’s completely free to get started, and you don’t even need to deposit anything—just post consistently, and you’ll get notified as your content gains traction.

🔥 Want to earn yield and front-run a potential airdrop?

Try infiniFi early with my referral link

Your click supports this newsletter and gets you direct access to the protocol before it breaks out.

Onchain Analytics

Bitcoin Exchange Reserves

Bitcoin reserves on centralized exchanges have continued their sharp decline, now reaching approximately 2.37 million BTC as of August 1st, 2025—one of the lowest levels recorded in recent years. At the same time, the price of Bitcoin has surged to an all-time high of $114,800, reinforcing the clear inverse correlation between exchange reserves and price.

This trend suggests growing investor preference for self-custody and long-term holding, reducing the available supply for trading. Historically, such conditions have led to supply shocks, where constrained availability meets increasing demand—often resulting in rapid price appreciation.

Notably:

The chart shows a persistent downtrend in exchange reserves from around 3.2 million BTC to 2.37 million BTC, marking a drop of over 25%.

During the same period, Bitcoin's price has more than quadrupled, despite multiple correction phases.

The divergence has accelerated in recent months, indicating heightened market conviction and likely institutional accumulation.

With fewer coins available on exchanges and most supply held in dormant wallets, Bitcoin is becoming increasingly scarce. If demand continues—or even plateaus at current levels—the price is likely to continue its upward trajectory due to basic supply-demand mechanics.

This ongoing liquidity squeeze is a strong bullish signal and may precede further parabolic moves if macroeconomic conditions or ETF inflows intensify.

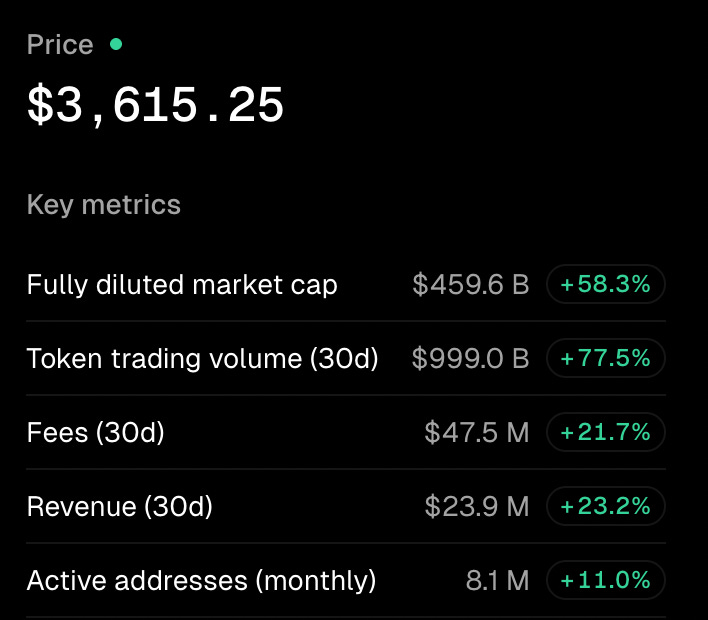

Ethereum Looks Strong Right Now

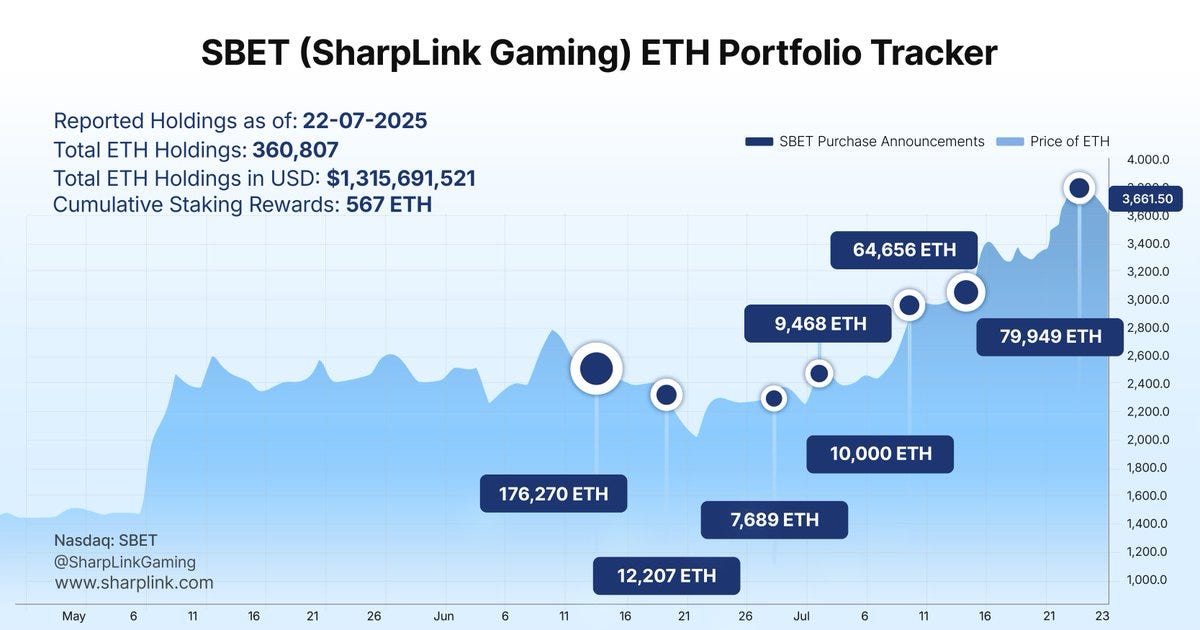

With recent restructuring at the Ethereum Foundation and the emergence of publicly listed Ethereum treasury companies like Bitmine and SharpLink, Ethereum appears stronger than ever.

NFTs are making a comeback, activity on both the mainnet and Layer 2s is increasing, and token trading volume has surged by 77.5% over the past 30 days.

In the short term, after an healthy pull back, Ethereum could easily go back to the $4000 mark given that Ethereum treasury such as SharpLink Gaming keep accumulating

We may soon see a wave of traditional finance (TradFi) companies racing to become the "next MicroStrategy." The key question is whether this trend is sustainable in the long term. In my view, Ethereum’s fundamentals remain intact. While it has lagged behind newer smart contract platforms like Solana, these alternatives do not offer the same level of economic security and network decentralization.

What I’m reading this week 📆

In this section, I curate the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Corporate crypto treasury holdings top $100B as Ether buying accelerates - read

Ethereum turns 10: Here’s how its booms and busts shaped history - read

SEC Chair Paul Atkins pledges to move financial markets onchain - read

Record crypto product inflows in July brings ETH demand into focus - read

CryptoPunks Floor Price Hits 3-Year High of $208,000 - read

Token Unlocks 🔓

IMX (1.30% of circulating supply) - August 08

STRK (3.31% of circulating Supply) - August 15

ARB (1.80% of circulating supply) - August 16

What I’m listening this week 🎧

In this section, I feature the week's most compelling DeFi podcasts and videos.

That’s it for this week.

If you found this edition valuable, please consider sharing it with your network — it helps grow our community and keeps the alpha flowing.

Follow me on X

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose

Lots of exciting projects happening