Weekly Alpha #43 – Bitcoin Below $100K; Altcoins Under Pressure

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome back to Weekly Alpha — your curated edge in DeFi, tokenomics, and macro shifts before they go mainstream.

In this edition of The Weekly Alpha:

🧑🌾 Bitcoin Below $100K; Altcoins Under Pressure

🧐 Onchain Analytics

What I’m reading this week

🎧 What I’m listening this week

🔓 Token Unlocks

Bitcoin Below $100K; Altcoins Under Pressure

Over the past few months, Bitcoin has shown remarkable strength, consistently trading near the $100,000 mark. Frankly, I expected it to break through $110,000 before retracing below $100K, especially given the recent wave of bullish sentiment: a friendlier regulatory outlook from the U.S. government and positive developments surrounding both Bitcoin and Ethereum.

Geopolitical Tensions: The U.S. Strike on Iran’s Nuclear Facility

However, the landscape shifted dramatically following reports of a U.S. strike on Iran’s Fordow nuclear site. While Bitcoin is often positioned as a store of value, the market clearly continues to view it—along with the broader crypto space—as a high-risk asset during moments of geopolitical uncertainty.

The potential for escalation between the U.S. and Iran looms large. In the short term, this uncertainty will likely drive heightened volatility across both Bitcoin and altcoins. That said, I remain confident in Bitcoin’s long-term store-of-value thesis; these developments are unlikely to derail its fundamental trajectory.

As an example of the market's rising concern, Polymarket’s prediction market on whether the Fordow facility will be further destroyed by July has surged to 53%—a clear sign that traders are bracing for further conflict escalation.

What’s Next?

As a long-term investor, I remain largely unconcerned with short-term price swings. In fact, I see this as an opportunity to continue dollar-cost averaging into Bitcoin. Whether tensions ease through diplomacy or escalate further, history shows that Bitcoin and the broader crypto market have repeatedly recovered over the long term.

Of course, the threat of a larger global conflict—possibly even the early signs of World War III—adds complexity. But this also underscores the value of holding self-custodied, sovereign assets such as Bitcoin or gold. In times of global instability, financial independence is more important than ever.

Conclusion

For short-term traders, especially those using leverage, caution is warranted. Geopolitical uncertainty—combined with the unpredictable nature of figures like Donald Trump—could trigger sharp, unexpected market moves.

For long-term holders, however, the playbook remains unchanged: stay the course, stick to your accumulation strategy, and expect volatility along the way. That said, I wouldn’t be surprised to see Bitcoin testing the $80,000 level before the market finds its next support zone.

🔥 Want to earn yield and front-run a potential airdrop?

Try infiniFi early with my referral link

Your click supports this newsletter and gets you direct access to the protocol before it breaks out.

Onchain Analytics

Base continues to dominate transaction activity with over 11.3 million daily transactions on June 21, 2025, reflecting a 3.3% daily increase, 5.2% growth over 30 days, and an impressive 253% rise over the past year. This confirms Base’s growing adoption, possibly driven by DeFi and social apps expanding on the network.

Bitcoin Exchange Reserves Hit Multi-Year Lows—A Brewing Supply Squeeze?

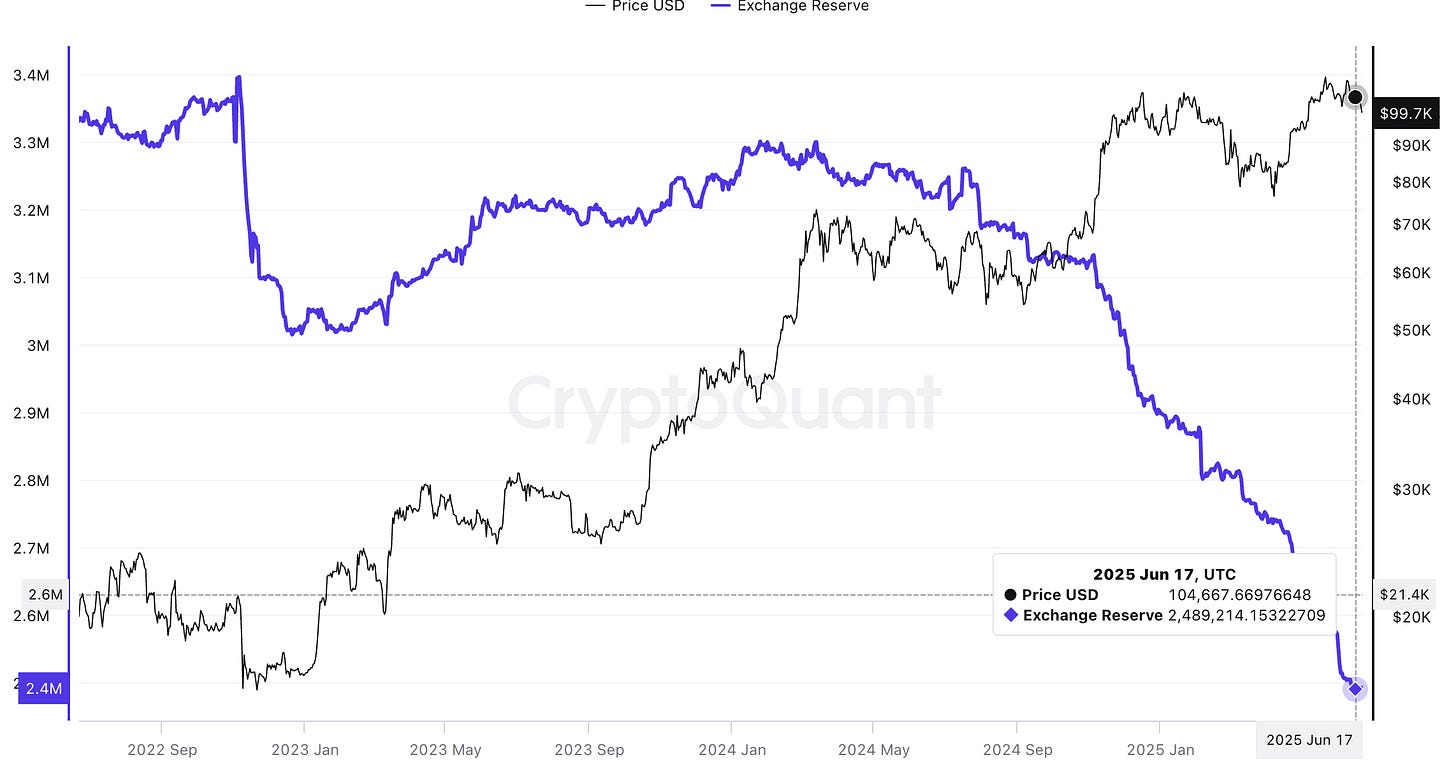

One of the most bullish on-chain signals for long-term Bitcoin holders is unfolding before our eyes. The chart below illustrates Bitcoin's Exchange Reserve metric (in blue), which has been on a steep and consistent decline since early 2024. As of June 22, 2025, reserves across centralized exchanges have dropped to approximately 2.49 million BTC—a level not seen in years.

This sharp reduction in exchange-held Bitcoin suggests that more coins are being moved into long-term self-custody rather than being left on trading platforms. Historically, such patterns have preceded supply squeezes, as fewer coins remain available to meet potential surges in buying demand—particularly from institutional players.

In plain terms: if demand spikes—whether driven by ETFs, sovereign funds, or corporate treasuries—there may simply not be enough liquid Bitcoin on exchanges to fulfill that appetite without triggering significant upward price pressure.

This scenario sets the stage for a potential supply shock, which could act as a powerful catalyst for Bitcoin’s next major price rally—especially in the context of recent macro and geopolitical uncertainties that are increasing Bitcoin’s appeal as a store of value.

With reserves at these historic lows and institutional interest continuing to build, the odds of a dramatic price repricing event are growing stronger.

What I’m reading this week 📆

In this section, I curate the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

ZachXBT slams Bitcoin bridge Garden Finance for laundering hacked funds - read

Staked Ether hits record high driven by corporate crypto treasury adoption - read

Samson Mow wants Bitcoin in ‘all of Europe,’ receives invite to France - read

Onchain Gold Trading Volume Hits Record High - read

Kraken’s Layer 2 Ink Unveils Token Launch and Airdrop - read

Token Unlocks 🔓

OP (1.79% of circulating supply) - June 30

STRK (3.79% of circulating Supply) - July 15

ZRO (23.13% of circulating supply) - July 20

What I’m listening this week 🎧

In this section, I feature the week's most compelling DeFi podcasts and videos.

That’s it for this week.

If you found this edition valuable, please consider sharing it with your network — it helps grow our community and keeps the alpha flowing.

Follow me on X

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose