Weekly Alpha #31 - Top Airdrop Farms of the Month 🧑🌾

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

🧑🌾 Airdrop farms of the month

📈 Market overview

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Ether Supply Grows Amid Activity Lull During New Year Holidays

ENS token surges 70% as Vitalik Buterin lauds platform as ‘super important’

Crypto hack losses declined 51% in 2023: Report

dYdX identifies attacker, considers legal action over $9M loss

Crypto traders remain bullish on Celestia (TIA) even after 480% rally

Ethereum’s Exit Queue Jumps To Record High As Celsius Unstakes

Airdrop farms of the month 🧑🌾

For this month's farming, we will exclusively focus on Manta to avoid spreading our capital too thin across various blockchains. Of course, you can still invest in crypto on any Layer 2 platform, but I want to keep this article centered around Manta to maintain clarity for everyone. Additionally, there are currently some excellent DApps deployed on this Layer 2 without a native token.

If you don't currently have funds on Manta, you can easily bridge them for a lower cost using platforms like Orbiter Finance. The reason I prefer Orbiter is that the native Manta Bridge is limited to transferring funds from Ethereum Mainnet to Manta, and I have shifted much of my activity to Layer 2 solutions.

Before bridging your assets to Manta, it's important to consider that the network is still in its early stages of development. You can find more information and data about Manta's progress on the L2beat website.

Now that you are aware of the risks and have successfully bridged to Manta, let's start farming some airdrops.

Shoebill V2

Shoebill is a fork of Compound V2 and boasts a total TVL of $38.29 million. This lending protocol stands as one of the most popular options on the Manta Network and, currently, it does not have its own native token.

They are currently running an incentive program that allows you to deposit and borrow assets while earning points, which could potentially lead to future airdrops.

Currently, there is a daily distribution of 16,000 MSBP tokens to users of the protocol. While it's essential to acknowledge the inherent risks, it's worth noting that the protocol has undergone an audit by Certik. While audits are not foolproof, they do demonstrate a commitment to security. Additionally, it's important to keep in mind that Shoebill is a fork of Compound V2.

How to farm on Shoebill

Go to the Manta Stone market

Supply Stone or ETH

By following this strategy, you'll be taking on fewer risks compared to leveraging through borrowing, and you can potentially earn a total APY of 32.20%. It's essential to remember that this APY includes points, and the performance of the Shoebill token in the future is uncertain.

PacificSwap V3

PacificSwap is a DEX forked from Uniswap V3 that doesn't have its own token yet.

With a total TVL of $759,952, it stands as one of the most popular DEX platforms on Manta. While PacificSwap is not exceptionally different, it offers an opportunity for airdrops. By utilizing this DEX, you can simultaneously farm PacificSwap and Manta tokens.

The current trading volume and liquidity are relatively low. However, if you're willing to take a calculated risk and seize the first-mover advantage, it could be a promising opportunity.

How to farm on PacificSwap

Swap on the DEX

Deposit concentrated liquidity to the DEX

When you examine on-chain analytics, you'll notice that many of the deposits are currently quite small and are primarily driven by participants looking to benefit from airdrops.

Being one of the popular DEX on Manta, it's worth considering taking a closer look at this DEX.

kiloex

For me, Kiloex stands out as one of the most intriguing projects on Manta. It's accessible on three different chains, and although I'm not a trader myself, this derivative protocol is quite explicit about their upcoming airdrop for users. It's worth dedicating time to farming this protocol, but it's important to acknowledge that it carries more risk compared to others. However, the potential rewards can be substantial. Remember to consider the risks associated with leverage trading and smart contract vulnerabilities.

Kiloex offers the ability to trade multiple assets with leverage of up to 100x, although this level of leverage is not advisable, especially for volatile assets. It's undoubtedly a risky endeavor, but there is a growing market for on-chain derivatives, and many individuals are showing interest, as seen with the activity on platforms like GMX and others.

Furthermore, you can accumulate points for every $2000 worth of assets deposited into the protocol or receive points through referrals. While these points are not tokens themselves, they could potentially lead to a rewarding airdrop if you're willing to invest the time.

Conclusion 🧠

Currently, Manta offers several excellent opportunities. Although the airdrop may not offer the highest risk-reward ratio compared to options like Eigen Layer, significant value can still be extracted with a relatively modest investment. As I've emphasized before, it's crucial to weigh the risks associated with providing liquidity to these protocols, and to Manta in particular. Therefore, I'm farming with only a small amount of money.

Weekly DeFi Market Update 📈

In this section, we'll take some time to examine useful metrics within the Ethereum ecosystem.

Stablecoin marketcap

In recent days, Tether has significantly increased its issuance, and the total market capitalization of stablecoins is now approximately $132 billion. Such rapid growth is a positive indicator of the vitality in the cryptocurrency sector, as it is likely to inject substantial liquidity into the market.

The 7-day change for Tether is currently at 1.11%.

Manta growth

Since the previous article focused on Manta, I believe it's important to track certain metrics to understand its growth.

Total Value Locked

Due to the ongoing airdrop farming, the Total Value Locked on Manta is increasing rapidly. At the time of writing this article, it stands at $337.48 million, with LayerBank being the most popular DApp on Manta.

Volume

The volume has also seen significant growth, with a +1512.47% change in the last 7 days, consistently staying above $1 million since January 1st.

Gas Price

The gas price on Manta remains very low, partly due to Celestia's role as a Data Availability Layer. This is beneficial for airdrop farmers.

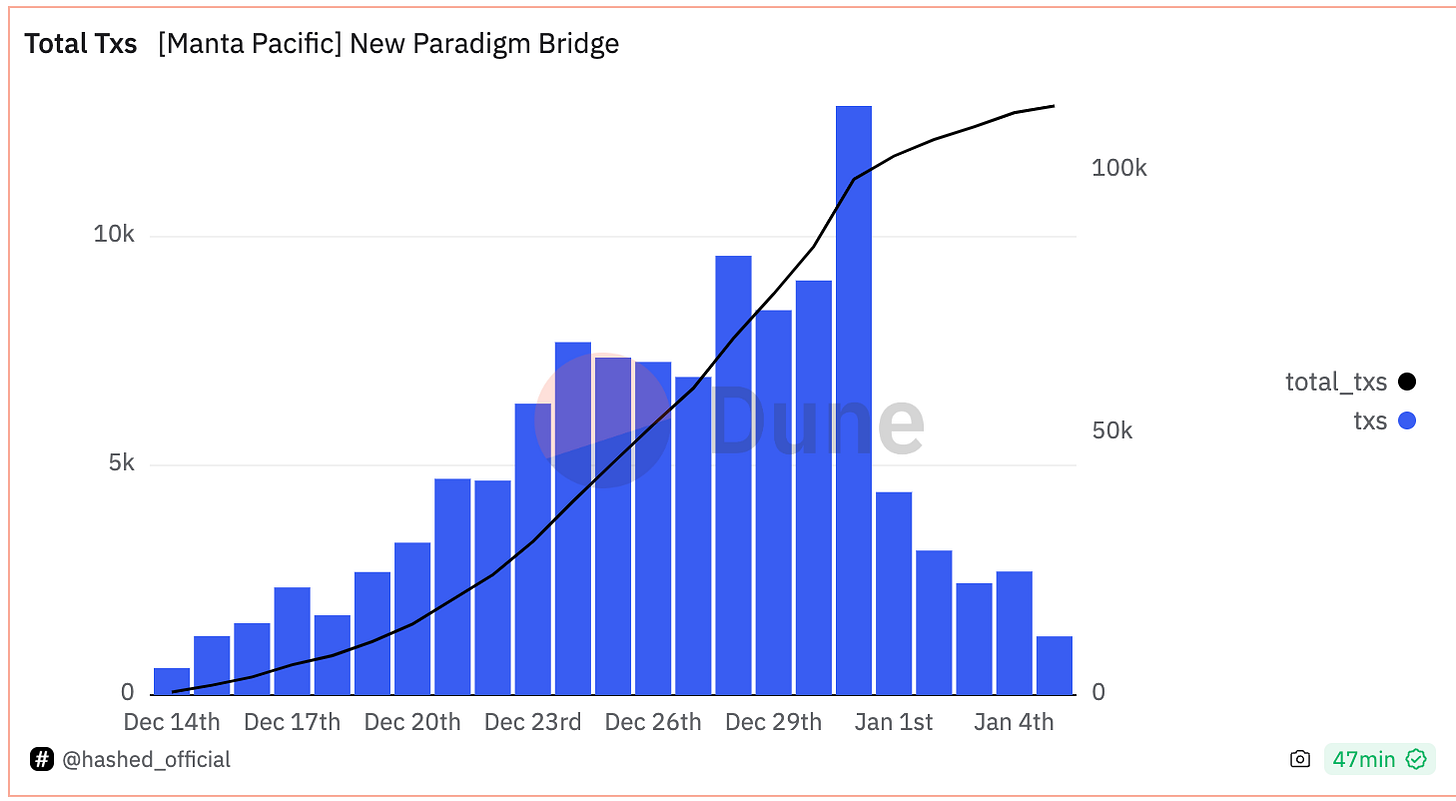

Total transactions

The total number of transactions on the New Paradigm Bridge has just surpassed the 100,000 mark, which is a notable achievement considering Manta's recent launch.

How are you positioning yourself for the upcoming bull market?

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose