Weekly Alpha #27 - This is Airdrop Season 🚁

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

🚁 Airdrop Season is here!

👩🌾 Actionable DeFi strategies

📈 Market overview

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Folks Finance Launches DeFi Services For Gold and Silver Tokens

Safe and Web3Auth Collaborate To Simplify Web3 Onboarding

Mantle Jumps On T-Bill Bandwagon With mUSD Stablecoin

DeFi Market Rebounds to $50B as Speculators Hunt for Yield

Crypto is for criminals? JPMorgan has been fined $39B and has its own token

KyberSwap announces treasury grants for hack victims

Journey to the center of DeFi: MetaMask creator introduces Linea Voyage

Airdrop Season is here!

This is a beautiful time before Christmas for receiving airdrops. I remember numerous significant airdrops during this season in the past, which helped trigger the previous bull market. For example, Uniswap's airdrop around September 2019 or 2020 was huge.

This year, Starknet, alongside LayerZero, has just announced an airdrop. These are two of the most anticipated airdrops in the ecosystem.

Over 1.8 billion STRK tokens will be allocated across various initiatives, including airdrops to users

Regarding LayerZero, there isn't much news about the token distribution yet. However, considering its widespread use across DeFi protocols, I wouldn't be surprised if there's a substantial airdrop for users, developers, and ecosystems that are building with LayerZero technology.

What we know so far is that the airdrop is scheduled to occur in the first half of 2024, which aligns closely with the timing of the Bitcoin halving!

Actionable DeFi strategies - Farm with STABLES

In this section, I'm sharing some intriguing DeFi strategies that you may find actionable. Please note that this is not financial advice, and it's crucial to conduct thorough due diligence before making any investments.

Farming ARB token with USDC 🛰️

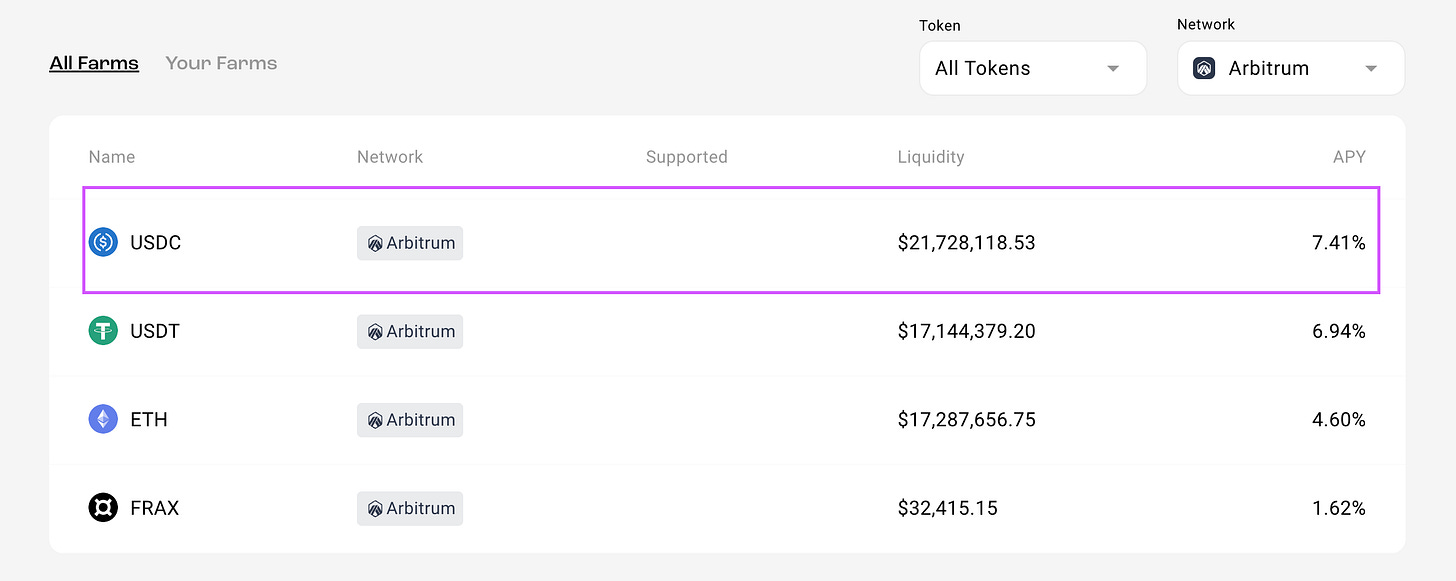

Stargate Finance currently offers several yield-generating opportunities on the Arbitrum network. Among these is the USDC Farm, where you can earn ARB tokens by depositing USDC, with an average annual percentage yield of 6.5%. Considering the low volatility risk associated with this option, I believe it represents an excellent strategy for those looking to actively utilize their stablecoins.

To farm ARB using USDC, you must first deposit your USDC into the designated pool on Stargate Finance.

Once you have the LP token, you can go to the Farming tab and deposit the LP into the USDC farm.

This strategy is straightforward and could potentially qualify you for a future LayerZero airdrop, as well as another round of ARB distribution. Sometimes, complex strategies are not necessary to achieve a good yield.

Risks

Smart-contracts exploits

USDC Depeg

hyUSD-eUSD vLP Vault On Beefy 🐮

This strategy carries higher risk due to its involvement with small market capitalization and multiple smart contract interactions. However, if executed successfully, the risk of impermanent loss is minimal, as both hyUSD and eUSD are designed to be stable. Nonetheless, proceed with caution when investing in this vault, as it involves risky assets with new mechanisms. By accepting these risks, you could earn up to 33.22% APY.

For transparency, I haven't personally used this vault, but I'm discussing it because it may be of interest to users seeking exposure to high-yield stablecoins and the Base network.

To enter the vault you can go to Beefy Finance

To deposit, simply select the token of your choice. You have the option to deposit LP tokens from Aerodrome Finance, or assets such as hyUSD or eUSDC. Once you complete this step, there's nothing more you need to do. The Aerodrome Finance governance token will be automatically converted and swapped for the LP token, allowing your position to grow.

Risks

Multiple smart-contracts interaction (Beefy, Aerodrome)

Depeg of the tokens

GRAI-LUSD On Ramses V2

This strategy is advantageous if you're aiming for low impermanent loss and the chance to qualify for a potential Gravita airdrop. With a current APY of 9.42%, you not only earn returns but also accumulate points towards the Gravita airdrop. Additionally, you can farm liquidity on Arbitrum using Ramses.

To execute this strategy, deposit both GRAI and LUSD into the Ramses pool, and focus the liquidity to maximize yield extraction. If you are uncertain about any steps, it's advisable not to alter any parameters.

Risks

Depeg of the tokens

Smart-contracts exploits

Weekly DeFi Market Update 📈

The L2 markets

It is now reasonable to conclude that we are entering a bull market, barring the occurrence of an unforeseen black swan event. If the current trajectory continues, Bitcoin is likely to reach an all-time high before the upcoming halving.

Regarding Layer 2 networks, the most popular ones have shown impressive performance in terms of profit generation over the past 30 days. For instance, Arbitrum has yielded a 32% profit in this period. With the resurgence of airdrop season, we can anticipate a surge in demand for block space in the upcoming weeks. Moreover, there has not yet been a significant movement in the NFT market.

I'm quite optimistic about Layer 2s, especially as many are advancing to stages 1 and 2 of decentralization. With Coinbase launching their chain, I anticipate that they will offer significant incentives to encourage their users to migrate to the Base Network. Additionally, similar to how Binance launched BNB, I believe Coinbase may introduce a token once the regulatory framework in the U.S. becomes clearer.

Stablecoins market cap on L2’s

The market cap of stablecoins is a particularly intriguing metric to track on new chains. As indicated in the chart below, there has been a growth of 5.8% in the last 30 days on Arbitrum. This increase is likely attributable to heightened DeFi activity and current incentives.

Currently, many traders are taking profits by utilizing stablecoins on on-chain derivatives exchanges. An example of such an exchange is GMX, which has been performing exceptionally well in terms of fees generated.

Bitcoin vs TradFI

It's not unexpected that traditional financeoften expresses skepticism or FUD towards Bitcoin and cryptocurrencies. However, when examining key metrics, it's evident that Bitcoin has been outperforming traditional finance. This trend is not limited to the last three months, as the chart below illustrates, but extends to a longer period, making Bitcoin a substantially stronger asset to hold overall.

The Rollups War

Currently, the daily transaction volumes of Arbitrum and Optimism show a correlation, with Arbitrum consistently maintaining higher numbers. I am eagerly anticipating what innovations Optimism will introduce during this bull market to capture a greater market share.

Conclusion

For this bull market, my strategy involves focusing on Layer 2 while maintaining a cautious approach by generating yield on DeFi DApps and participating in airdrop farming. I anticipate a significant number of upcoming airdrops; recent announcements from Starknet and LayerZero support this view. Additionally, other Layer 2 solutions like Scroll and Linea are likely to follow suit, especially given the current bullish trend. This makes it an opportune time for these platforms to launch their airdrops.

How are you positioning yourself for the upcoming bull market?

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose