Weekly Alpha #26 - Dominance, Supply Dynamics, and Market Trends 📈

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

👩🌾 Actionable DeFi strategies

📈 Market overview

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Blast Attracts Widespread Criticism Despite Surging TVL

Vertex Activity Surges With $1.5B In Daily Volume

Stakewise Plans to Launch New Liquid Staking Token and Validator Marketplace

Uniswap DAO Approves Delegation Of 10M UNI To Active Voters

Wormhole raises $225M at $2.5B valuation

Over 75% of Web3 games ‘failed’ in last five years: CoinGecko

DeFi could solve Africa’s foreign exchange problems, neobank CEO says

“Unhinged” Kyber Hacker Demands Complete Control Over the DEX

OpBNB Leads Superchain Adoption While Base and Optimism Lag

Actionable DeFi strategies 👩🌾

In this section, I'm sharing some intriguing DeFi strategies that you may find actionable. Please note that this is not financial advice, and it's crucial to conduct thorough due diligence before making any investments.

EXTRAFI USDC Deposits 💲

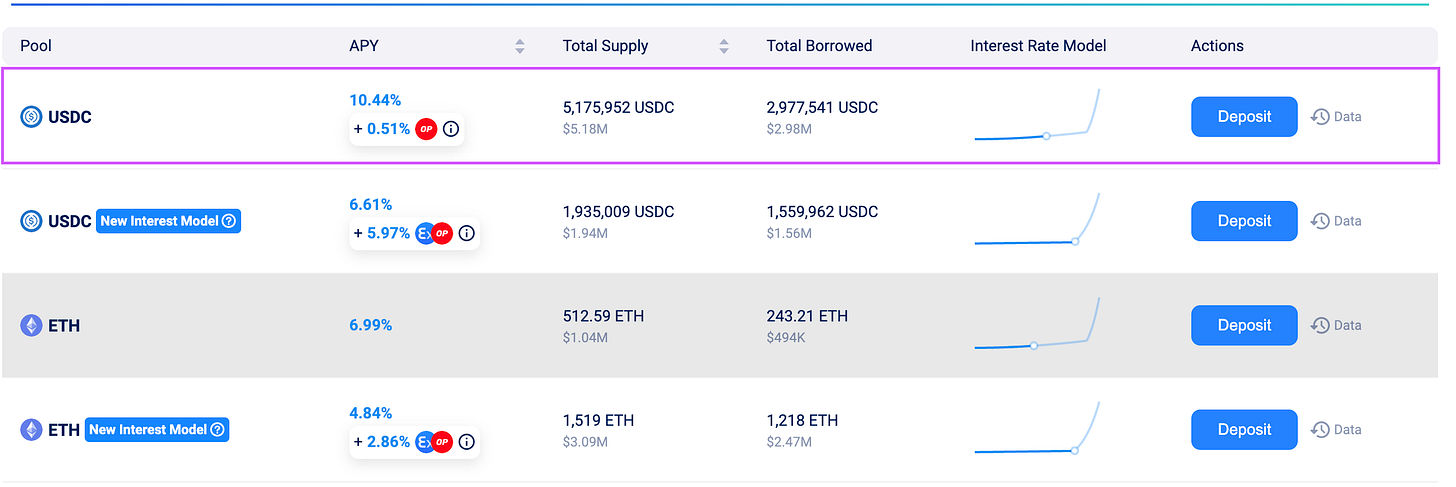

Extra Finance, a leveraged yield strategy and lending protocol, is built on the Optimism and Base platforms.

It offers an attractive APY for USDC deposits on Optimism. Over the last 30 days, the APY has averaged around 10.98%.

This strategy is straightforward and suitable for beginners, akin to making a deposit on AAVE.

Simply navigate to the lending page and deposit your USDC. Additionally, on top of the USDC APY, you will earn rewards paid in OP tokens.

QUICK-MATIC LP Vault On Beefy 🐮

The QUICK-MATIC LP Vault, a more aggressive strategy on the Polygon POS, offers an APY of 52.28%.

Managed by Gamma, it ensures liquidity stays within a targeted range and automatically compounds trading fees. QUICK-MATIC is staked to earn additional rewards, which are then reinvested into more QUICK-MATIC.

Gains Network gDAI vault on PenPie

If you've been following my updates, you're likely aware of my fondness for the Pendle ecosystem. Penpie is a component of this ecosystem, akin to how Convex relates to Curve.

The Gains Network's gDAI vault provides substantial incentives for its users. By participating, you can earn PNP, swap fees, Pendle incentives, gDAI, and ARB incentives simultaneously, with an APR of 28%.

Once you accumulate sufficient PNP, you have the option to lock them in vlPNP at a 1:1 ratio, offering an APR of up to 68%, which includes the ARB incentive. This approach is certainly more aggressive and speculative, but it can yield high returns. However, it's important to remember the risks involved, as highlighted by the recent exploit on Equilibria, another yield booster in the Pendle ecosystem. Like all smart contracts, this strategy is not free of risks.

Weekly DeFi Market Update 📈

Arbitrum ecosystem

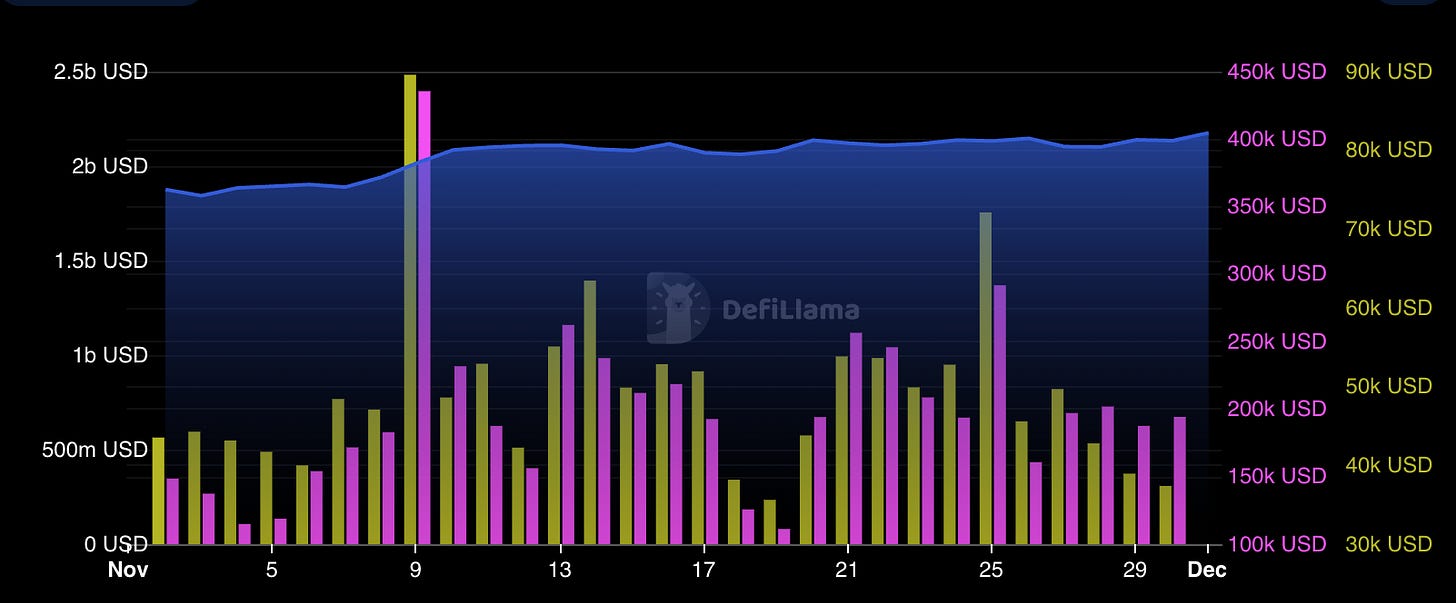

The new Arbitrum incentive program, aimed at enhancing liquidity on Layer 2, has resulted in a modest increase in both the TVL and revenue for Arbitrum.

At present, numerous Dapps are offering ARB incentives, which, combined with the current market uptrend, is contributing to the modest increase in TVL. Currently, Arbitrum's TVL stands at $2.176 billion, with GMX dominating 23.22% of it. Arbitrum is, by a significant margin, the most utilized Layer 2.

Regarding risk analysis, Arbitrum is one of the few Layer 2s in Stage 1, with three issues needing resolution to advance to Stage 2. These include:

Upgrades unrelated to on-chain provable bugs provide less than 30d to exit.

Fraud proof

The Security Council’s actions are not confined to on-chain provable bugs.

Bitcoin Metrics

Typically, before entering a bull market, Bitcoin exhibits strong performance, marked by increased market dominance and a higher amount of Bitcoin being held off exchanges.

Dominance

The chart below illustrates that Bitcoin's dominance is currently over 53%, representing a 32% increase within a year, which, in my opinion, signals a bullish trend for the market.

While this is only a theory, I believe that since 2017, whenever Bitcoin's dominance peaks, there tends to be a redistribution of profits into altcoins, marking the beginning of a bull cycle. During this phase, investors often shift towards riskier assets for a short period, leading to parabolic movements in the market.

Bitcoin Balance on exchanges

In the chart provided below, it's evident that the balance of Bitcoin held on exchanges continues to decrease this month. In my view, this is a highly bullish trend, which could lead to a supply shock if demand remains strong. With fewer Bitcoins in circulation and the growing narrative around ETFs, this metric, in my opinion, is crucial to monitor.

We are currently witnessing a very bullish trend within the Bitcoin and Ethereum ecosystems. This trend is reminiscent of the early stages of the previous bull market, characterized by a surge in DeFi activity, an increase in Bitcoin being held off exchanges, and rising market dominance.

While there's always the potential for a black swan event, as is common in the crypto world, if we continue on this trajectory, we might soon enter a robust bull market, coinciding with the next Bitcoin Halving, which is expected to occur in approximately 138 days, on April 17, 2024.

Regarding my investment strategy, Bitcoin constitutes the primary asset in my portfolio, followed by Ethereum. Additionally, I hold some more volatile assets with compelling narratives and airdrops that I have retained, such as Optimism or Arbitrum.

How are you positioning yourself for the upcoming bull market?

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose