Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

👩🌾 Actionable DeFi strategies

📈 Market overview

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Aave Companies Rebrands as Avara to Reflect the DeFi Giant's Multiple Holdings

ENS Challenges Unstoppable Domains to Open its Blockchain Domain Name Patents

Trade Volume For Rocket Pool’s rETH Outpaces stETH By 430%

Smoothly Launches Gitcoin Campaign To Bolster Rewards For Solo Stakers

THORchain Volumes Surge On Success Of ‘Streaming Swaps’

Ethereum Validators Are Now Queuing To Exit The Network

Pyth Network Token Goes Live With $75M Airdrop For DeFi Users

Tron’s JustLend Surpasses Aave As Largest Web3 Lending Market

Upstart Layer 2 Blast Draws In $100M With Airdrop Scheme

Swiss City of Lugano Embraces Crypto With Polygon Integration

Circle Launches Bridged USDC Contract For EVM Chains

CrvUSD Proposal Aims to Increase Rates and Restore $1 Peg

ETH price reclaims $2K as data shows a surge in network activity

Actionable DeFi strategies 👩🌾

In this section, I'm sharing some intriguing DeFi strategies that you may find actionable. Please note that this is not financial advice, and it's crucial to conduct thorough due diligence before making any investments.

SNX-USDCe vLP V2 Vault 🐮

The vault available on Beefy Finance is offering an attractive annual percentage yield of 63%, enhanced by Optimism (OP) rewards.

The strategy employed by the vault is straightforward: it involves depositing the user's SNX-USDCe vLP V2 tokens into a Velodrome farm. This process generates the platform's governance token. The earned token is then exchanged for SNX and opUSDCe, which are used to acquire more of the same LP token.

A key aspect that makes this strategy effective is that, in addition to the yield from Velodrome, it also generates OP tokens.

Risks

Engaging with Multiple Smart Contracts

High expected Impermanent Loss

SNX is very volatile

Weekly DeFi Market Update: A Rollercoaster Ride 📈

This week in DeFi has been a whirlwind, beginning with a significant downturn and culminating in a return to prior levels.

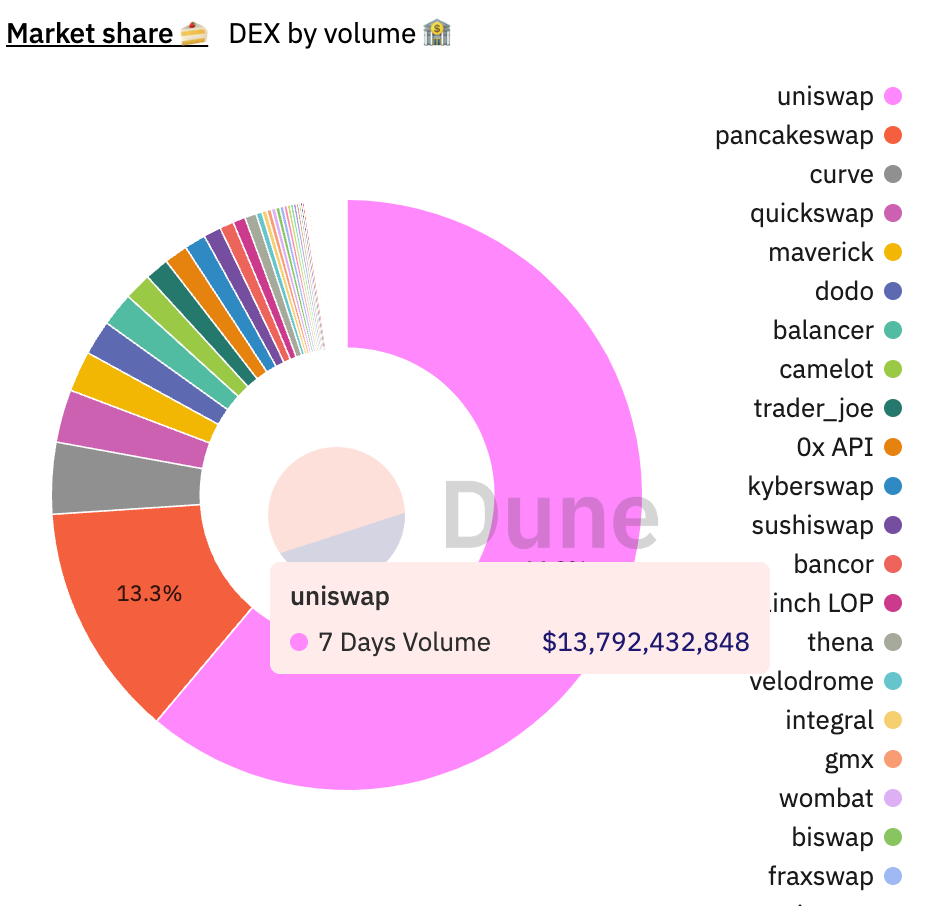

The last seven days have seen impressive DEX volume, exceeding $22 billion. This surge is largely attributed to Layer 2 solutions, which have significantly reduced fees for users.

Over the past seven days, Uniswap has maintained its lead in market share, commanding 64% with a trading volume surpassing $13 billion.

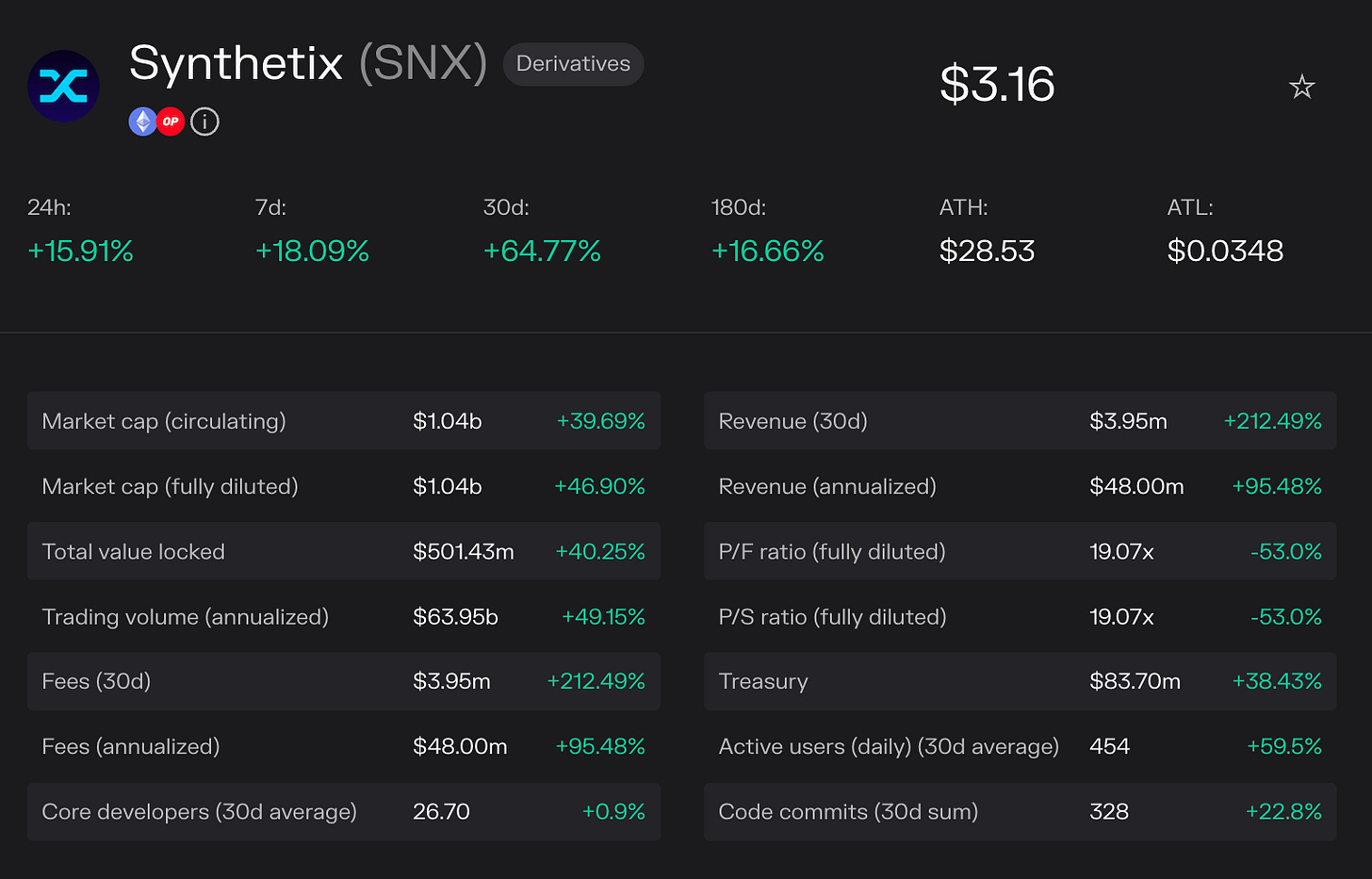

Synthetix, currently operational only on Ethereum Mainnet and Optimism, has shown notable growth with an 18% increase in the last 7 days, alongside a significant 212.48% revenue growth. This uptrend aligns closely with the token's price, which surged by 61.8% in the past 30 days. Additionally, the anticipation of Synthetix V3 and Infinex, set to launch soon, adds to the excitement.

This week marked a strong period for DeFi within the Ethereum ecosystem. If this growth trend persists, we could see a 'snowball effect' with fresh capital influx. Personally, I'm focusing on maximizing liquidity extraction through farming in anticipation of a potential bull market. The DeFi season of 2020 seems to be gaining momentum for me in recent weeks.

I've begun exploring the Cosmos ecosystem, especially after the Celestia airdrop, to gain a better grasp of its economics.

However, from what I understand, the activities on application-specific chains don't directly impact the Cosmos blockchain itself.

I'm curious to know how you are preparing for the bull market.

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose