Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

👩🌾 Latest Yield Farming Opportunities

📈 Market overview

🔍 In-depth Analysis: Gravita Protocol

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Uniswap Labs’ fee switch yields $120K in opening days

New DeFi protocols aim to jumpstart L2 Rollux

Uniswap founder burns $650B HayCoin against speculation

Base network launches 8-week training course for blockchain developers

Uniswap Visa Card Proposal is Facing Opposition Among UNI Token Holders

DeFi Sector Heats Up Amid Broad Market Rally

Friendtech Hit By Selloff As SocialFi Whales Move To New Bitcoin City

DYdX steps closer to v4 by open-sourcing code

Polygon Deploys POL Token On Ethereum

Maestro Trading Bot Exploited For $500K

Arbitrum Orbit integrates Celestia for data availability

LayerZero’s wstETH bridge deployment draws Lido DAO ire

Cloud computing is operated by an anti-competitive oligopoly, says Osuri

Alpha Yield Opportunities 👩🌾

If you're looking for the best yield opportunities, I've curated them for you in this section.

PolyLend (Polygon zkEVM) - 6,289% APR on the WETH pool (degens alert 🚨)

Extra Finance (Optimism) - 7.67% APY + rewards on USDC deposits

Pendle Finance (Arbitrum) - 7.6% APY on rETH liquidity pool

Beefy Finance (Arbitrum) - 270.56% APY on the MAGIC-ETH LP Vault

Hop Exchange (Base) - 10% APR on the USDC Pool

DeFi market overview 📈

Owing to speculation about the Bitcoin ETF, the Total Value Locked has risen this week, currently standing at $41.068 billion. While this figure doesn't approach the previous all-time high, it represents a positive beginning several months ahead of the next Bitcoin halving event.

At this point, I believe the market could take any direction, but I would personally prefer to see it stabilize. Parabolic trends aren't really healthy for long-term growth, and it seems premature to kick-start a bull market at this stage. However, my strategy remains unchanged: I'm engaged in yield farming, consistently investing a set amount in Bitcoin and ETH through dollar-cost averaging, and depositing my stablecoins in lending protocols to earn yield.

The most important thing during these times, as we begin to witness euphoria, is to remain focused and calm.

TVL across Networks

Arbitrum continues to lead significantly in terms of TVL, with Optimism following closely behind. It's impressive to witness such robust growth, especially since both networks have already launched their tokens. The pertinent question now is how these platforms will manage high transaction per second (TPS) rates when the bull market returns and network congestion increases. We experienced network downtimes during the claim periods for both Arbitrum and Optimism tokens, illustrating potential scalability issues.

Uniswap Fee generated

Since Uniswap Labs introduced the controversial frontend fee, they have already generated $498,443 in revenue.

In-Depth Analysis: Gravita Protocol 🔍

One of the most compelling narratives at the moment centers around LSTs, with their capacity to tokenize Ethereum security. This feature offers everyone the opportunity to own an ETH yield-bearing asset without the necessity of holding 32 ETH, which is a stark contrast to the requirements of running an Ethereum node. With LST tokens, individuals can engage them in various DeFi strategies to maximize their yields, and Gravita stands at the forefront of this innovation.

You can utilize a range of LSTs to secure loans, and in this article, we're going to delve into what makes this particular approach an enticing DeFi protocol.

Today's Status ⚙️

Gravita is a decentralized borrowing protocol offering interest-free loans, secured by a Stability Pool and Liquid Staking Tokens.

Loans are issued through the minting of GRAI tokens, employing a mechanism similar to that of LUSD. These loans can amount to up to 90% of the value of a user's collateral. However, borrowers should exercise caution to avoid liquidation when opting for high-value loans.

Networks Availability:

Ethereum Mainnet: Fully Deployed ☑️

Arbitrum: Fully Deployed ☑️

zkSync Era: In Progress ⚙️

Optimism: In Progress ⚙️

Polygon zkEVM: In Progress ⚙️

Base: In Progress ⚙️

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

Gravita On-Chain Metrics 🧐

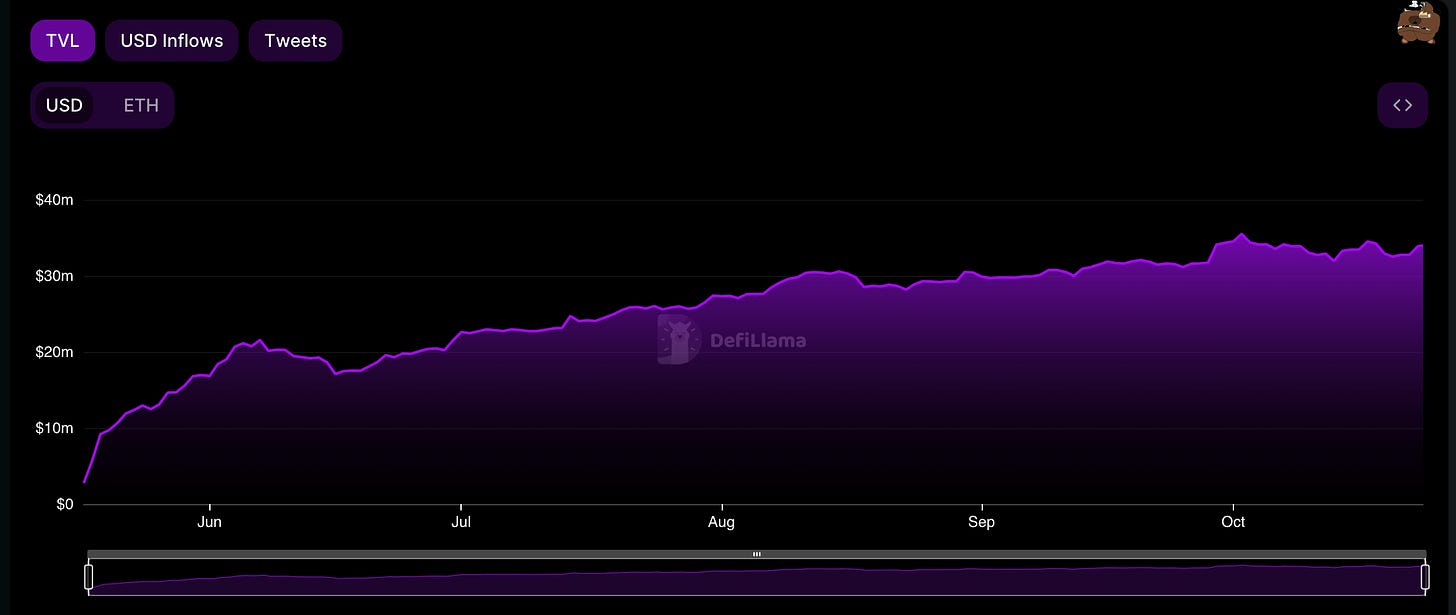

The current Total Value Locked (TVL) of Gravita Protocol stands at $33.97 million, distributed between $31.91 million on Ethereum mainnet and $2.06 million on Arbitrum.

TVL is determined by calculating the aggregate value of the assets locked as collateral within the protocol.

Currently, Gravita has launched a total of 887 vessels. I will explain what these vessels entail later in this article, so please stay tuned.

The price of GRAI, the stablecoin token of the protocol, is currently $0.98. Historically, it has consistently been slightly below $1. This slight undervaluation is due to the token being overcollateralized, which means the value of the collateral held is more than the amount of issued GRAI, ensuring its stability.

How To Use Gravita?

There is two main module on Gravita, the Stability pool and the Vesssel, after this small tutorial, you will be able to take a loan against your LST tokens and deposit GRAI in the stability pool to farm a potential future airdrop.

The Vessels

A vessel is a platform where you can deposit collateral in exchange for borrowing GRAI stablecoins. Similar to vaults or Collateralized Debt Positions (CDPs), Vessels maintain two balances: one representing the assets held as collateral, and the other representing debt, denominated in GRAI. You can modify these amounts by either adding collateral or repaying debt, actions that in turn alter your Vessel's loan-to-value (LTV) ratio.

You have the option to close your Vessel at any time, except during periods when the system is in Recovery Mode, by settling your debt in full.

Opening a Vessel is quite straightforward. First, on the borrow page, you need to select the type of collateral against which you wish to borrow GRAI.

In this example, let's consider using wstETH on Arbitrum.

In this scenario, I'm using wstETH with a Loan-To-Value (LTV) ratio of 48.89%, borrowing 969.86 GRAI. The higher the LTV, the greater the risk of your Vessel being liquidated, so ensure that the risk is justified.

As illustrated in the screenshot above, my Vessel faces liquidation if the value of wstETH drops to $1,169.78. At that point, I have a total outstanding debt of 994.71 GRAI, equivalent to 994.71 USD. The "fee refund" ranging from 0 - 4.66 GRAI refers to a special feature where repaying the debt within six months entitles you to a pro-rated refund of the 0.5% fixed borrowing fee, based on the time elapsed, subject to a minimum charge equivalent to one week's interest.

The liquidation reserve is funds set aside to guarantee protocol stability in the event of liquidation.

The Stability Pool

The Stability Pool plays a crucial role in Gravita, serving as the primary defense line in ensuring system solvency. When a Vessel undergoes liquidation, an amount of GRAI equivalent to the outstanding debt of that Vessel is burned from the Stability Pool's balance to cover the debt. In return, all collateral from the liquidated Vessel is transferred to the Stability Pool.

To support the Stability Pool, participants must use GRAI, Gravita Protocol's stablecoin. Upon the occurrence of a Vessel liquidation, participants can earn profits from this event and potentially acquire GRVT, Gravita's forthcoming governance token.

By depositing GRAI tokens into the Stability Pool, participants will, over time, experience a pro-rata reduction in their GRAI deposits. Conversely, they gain a pro-rata share of the collateral claimed from liquidations.

For instance, in the case of WETH Vessels, these are often liquidated at slightly above a 90% loan-to-value (LTV) ratio. Consequently, it is anticipated that Stability Providers will receive collateral with a higher dollar value compared to the debt they help eliminate.

Now that you have GRAI

As I mentioned earlier, GRAI is a stablecoin, meaning you could technically use it for everyday purchases like a boat or a new pair of AirPods. However, our focus here is capital growth. In this section, I will outline several DeFi strategies to employ your GRAI effectively, aiming to expand your capital and ultimately repay your loan.

Ramses Exchange on Arbitrum

RAMSES is a ve(3,3) DEX that expands upon Andre Cronje's concept of solidity.

Several GRAI pools are available, offering a range of high APRs.

Bunni on Arbitrum

Bunni is a liquidity engine for incentivizing Uniswap v3 liquidity.

The GRAI/USDC pool currently offers attractive incentives on Bunni, with an APR ranging between 3.91% and 14.42% at the time of writing this article.

Liquis on Ethereum mainnet

Liquis is a liquid governance wrapper for Bunni Pro, a liquidity management solution on top of Uniswap v3.

The GRAI/USDC liquidity pool provides an APR of approximately 17%, presenting an opportunity for those looking to put their GRAI to productive use.

Ascend incentive program

First and foremost, Gravita currently doesn't have a governance token. However, they have introduced an incentive program named Ascend, where participants can earn MARKS by performing certain activities, such as providing liquidity to the stability pool or engaging with the aforementioned protocols.

I surmise that the more MARKS one accumulates, the greater the potential to amass governance tokens in the future.

If you've already deposited liquidity and haven't observed your MARKS reflecting yet, there's no cause for alarm. The snapshot updates might take a while, and you can check the timestamp of the most recent update at the bottom of the screen.

Risks

It's crucial to discuss the risks associated with using such protocols. One potential risk could involve the GRAI stablecoin deviating from its peg, which could significantly undermine the project. Other risks include possible smart contract exploits or the risk of users getting liquidated. Therefore, it's essential to proceed with caution when investing in a new protocol, being fully aware of these potential challenges.

Final thoughts 🧠

Gravita may not have amassed a significant amount of Total Value Locked yet, but it stands as a robust alternative to more centralized stablecoins that are challenging to audit. I appreciate the incentive program they are developing, which encourages users to contribute liquidity to the Stability Pool or engage with various protocols using GRAI.

The LUSD model has shown its efficacy so far, and since it's overcollateralized with ETH, it positions itself as more decentralized compared to USDC, USDT, or even DAI, which is a quality I find appealing.

Personally, I wouldn't invest more than I can afford to lose until the protocol reaches a stage of greater maturity. However, it's beneficial to explore various options, delve into different solutions, and observe teams innovating in the realm of stablecoin backing, especially concerning LST.

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose