Weekly Alpha #20: Dive into Ekubo - The Next Gen AMM on Starknet

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

👩🌾 Latest Yield Farming Opportunities

📈 Market overview

🔍 In-depth Analysis: Ekubo Protocol

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

RWA Protocol Goldfinch Writes Down $7M of $20M Stratos Loan to $0

KYC hook for Uniswap v4 stirs community controversy

Web3 Watch: SocialFi apps secure funding despite investment lull

Ethereum losing streak vs. Bitcoin hits 15 months — Can ETH price reverse course?

Uniswap Labs to institute 0.15% fee on select assets and frontends

Ether.fi steps closer to liquid restaked token for EigenLayer

Lightning Labs teases protocol for minting RWAs, stablecoins on Bitcoin

Alpha Yield Opportunities 👩🌾

If you're looking for the best yield opportunities, I've curated them for you in this section.

Stake DAO (Mainnet) - 1,446% APR on the MAV locker

Sonne Finance (Optimism) - 21.53% APY + 1.68% rewards on supplying MAI

Neutra Finance (Arbitrum) - 12.926% APY on the USDC vault

Stargate Finance (Base) - 4.33% APY on USDC farm

ZeroLend (zkSync Era) - 2.07% APY on USDC deposits + Rewards

DeFi market overview 📈

It's been another slow week with the total TVL (Total Value Locked) remaining under $40 billion, exacerbated by market volatility due to false rumors of a Bitcoin spot ETF approval. On a different note, we are seeing some activity with the launch of Scroll's mainnet, which is now finally live.

Top Protocols by Revenue Ranking

Examining the revenue over the past seven days, MakerDAO persists in its strong performance, generating $3.58 million, while Friend Tech is close behind, nearing $800,000.

In the Rollup category, zkSync leads in terms of revenue, having accumulated $391,475.

TVL across Networks

When examining the TVL across different networks, Solana has recently surpassed Base in terms of value. However, it still lags significantly behind both Arbitrum and Optimism. Among the rollups, Arbitrum continues to hold a dominant position, showcasing its strong presence and trust within the community.

Daily Active Addresses

Analyzing the daily active addresses, it's evident that zkSync, Era, and Starknet are leading the way in the L2 space. A significant driver behind this dominance appears to be airdrop farming, which has attracted a considerable number of users to these platforms.

In-Depth Analysis: Ekubo Protocol 🔍

In the DeFi market overview section, it's highlighted that Starknet boasts a substantial number of daily active addresses. However, as of now, there aren't any significant Dapps present. This week, I delved deeper into the Starknet Ecosystem and discovered Ekubo, which can be aptly described as Uniswap V4 on steroids.

Today's Status ⚙️

Ekubo Protocol is developed on Starknet by a former member of the Uniswap team. This highly efficient AMM has recently introduced features such as concentrated liquidity and gas efficiency using the 'Till pattern.' Furthermore, its singleton design ensures cost-effective trades with concentrated liquidity.

Ekubo also offers Extensions, enabling third-party developers to seamlessly create new types of pools. These integrate smoothly within the broader ecosystem of aggregators and interfaces built atop Ekubo. Moreover, these pools can incorporate novel features like oracles, as well as unique order types, including limit orders and TWAMM orders.

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

Ekubo On-Chain Metrics 🧐

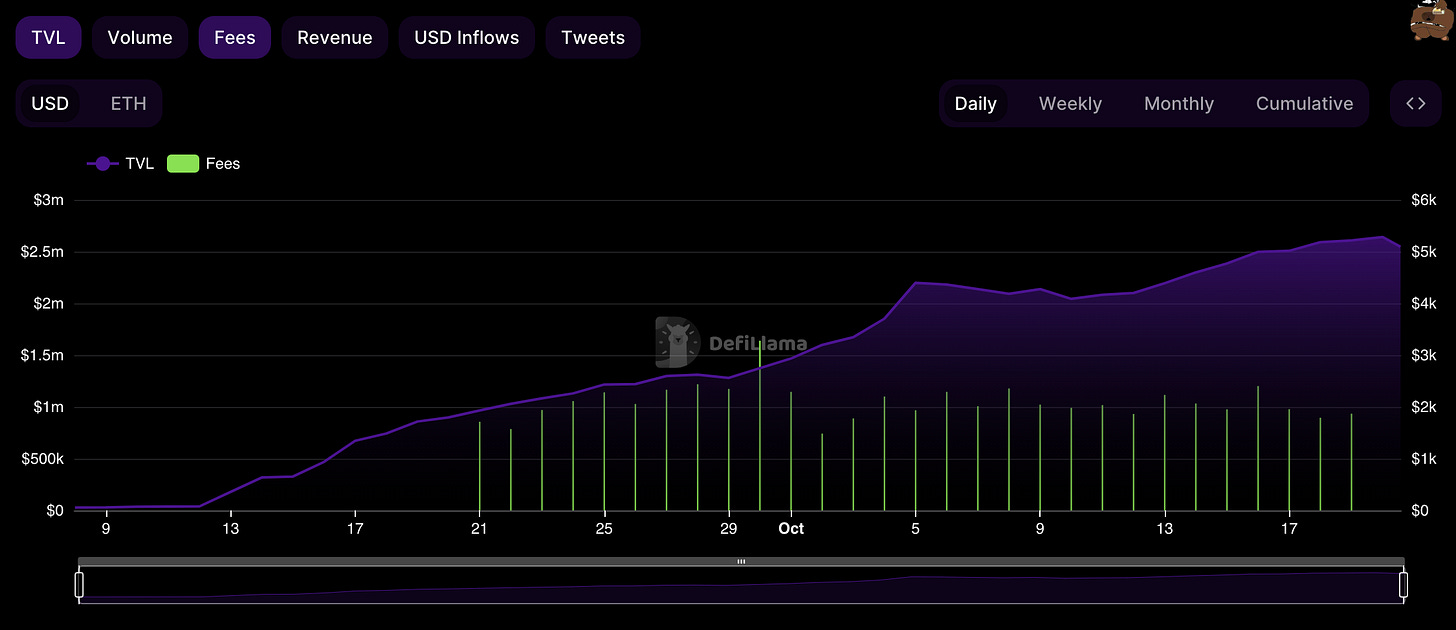

Ekubo's current TVL stands at $2.55 million, and its daily trading volume fluctuates between $8 million and $13 million.

Ekubo's fees typically range between $1k and $2k, generating approximately $150 in revenue daily. These metrics are calculated as follows:

TVL: Represents the value of the Liquidity Provider (LP) assets in the DEX, which includes LPs that are out of range and consequently not contributing active liquidity.

Fees: These are the swap fees paid by users.

Revenue: This is the portion of swap fees directed to the treasury and/or token holders.

How To Use Ekubo?

Swap Tokens

Ekubo doesn't have its own frontend for token swaps. Instead, you can use AVNU, a DEX aggregator, to access Ekubo's liquidity.

Do note that a Starknet wallet is required. For this, I'd recommend Argent X; its setup is as straightforward as Metamask.

Provide Liquidity

Here's where things get interesting: In Ekubo, you have the option to provide liquidity to the protocol. It's worth noting that the protocol hasn't released a token yet. I came across an 'Airdrop' repository on GitHub which the team has since made private. Given this, I'm fairly confident there will be an upcoming airdrop.

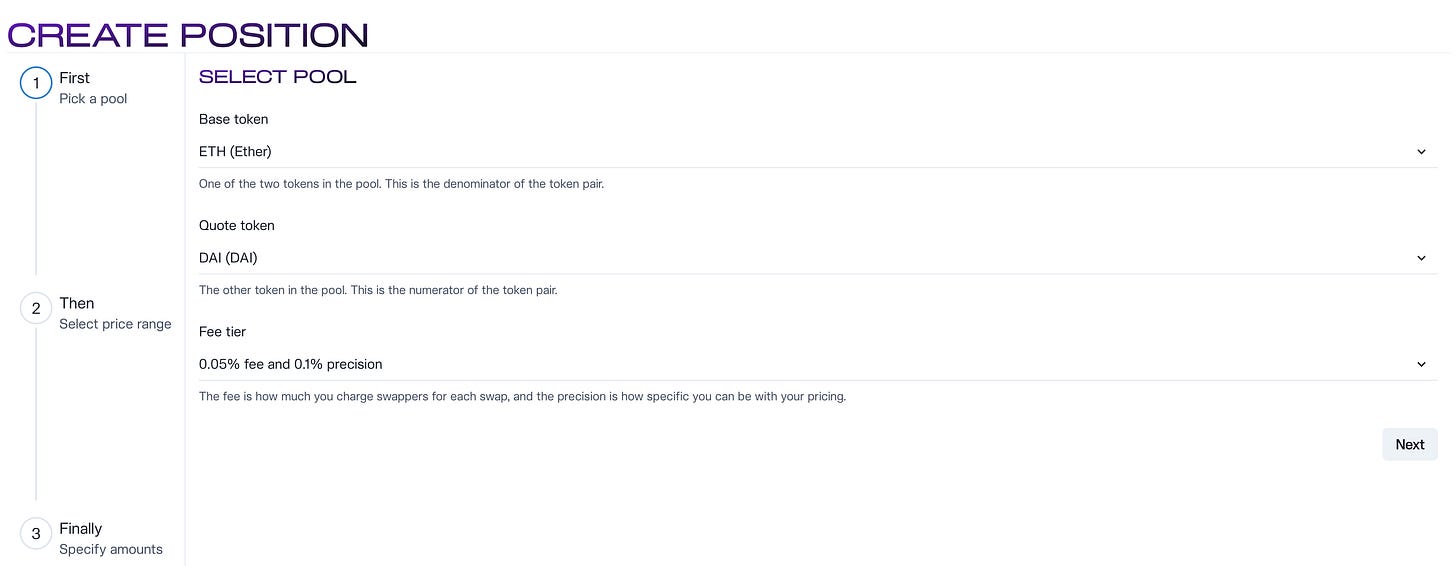

To provide liquidity, navigate to the "Manage Liquidity" webpage. From there, you can create a new position.

Once you've navigated to the position page, you can choose a pool and adjust your parameters for optimal efficiency. I suggest experimenting to determine the best settings.

Final thoughts 🧠

Ekubo operates using a smart contract named Cairo, as Starknet isn't EVM-compatible. It's intriguing to observe new design patterns and the Dapps that will bolster Starknet's growth. My experience with Ekubo showed that the DEX is exceptionally efficient, particularly when setting up new positions. While there's a withdrawal fee upon creating a position, this decreases the longer you maintain liquidity.

Overall, Ekubo ranks as one of my top AMMs. Seizing the early-bird advantage for a potential airdrop could position us favorably. I'm confident that Ekubo is on its way to becoming the premier AMM on Starknet.

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose