Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

In this edition of The Weekly Alpha:

🗞️ Weekly DeFi News Digest

👩🌾 Latest Yield Farming Opportunities

📈 Market overview

🔍 In-depth Analysis: MUX Protocol

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

VanEck To Support Ethereum Development With 10% of Ether ETF Profits

Tether treasury receives two $50M USDT lump sums from Bitfinex

Friend.tech users blame SIM swaps after more than 100 ETH drained in a week

Optimism devs tackle bad actors with fault-proof system testnet launch

Chainlink moves a step closer to creating a decentralized computing marketplace

Proposal for Stargate Deployment on Mantle

THORSwap goes into 'maintenance mode' to counter illicit funds movement

Radiant Capital reschedules Ethereum mainnet launch

Alpha Yield Opportunities 👩🌾

If you're looking for the best yield opportunities, I've curated them for you in this section.

Stargate Finance (Arbitrum) - 4.12% APY on the ETH Farm (ARB Rewards)

Beefy Finance (Optimism) - 523.57% APY on the EXA-WETH vLP V2 vault

Extra Finance (Base) - 15.95% APY on the USDbC Lending Pool

Pearl Exchange (Polygon) - 22.81% APR on the USDC/USDR Pool

Stargate Finance (Fantom) 4.75% APY on the USDC Farm (STG Rewards)

DeFi market overview 📈

Total TVL

The total TVL across all networks has remained relatively stable since last week. It was $38.532 billion last week and is currently $38.608 billion. Despite the bear market, there haven't been significant changes, indicating a flat yet healthy market.

Top Protocols by Revenue Ranking

Friend.tech has maintained higher revenues than MakerDAO over the past 7 days.

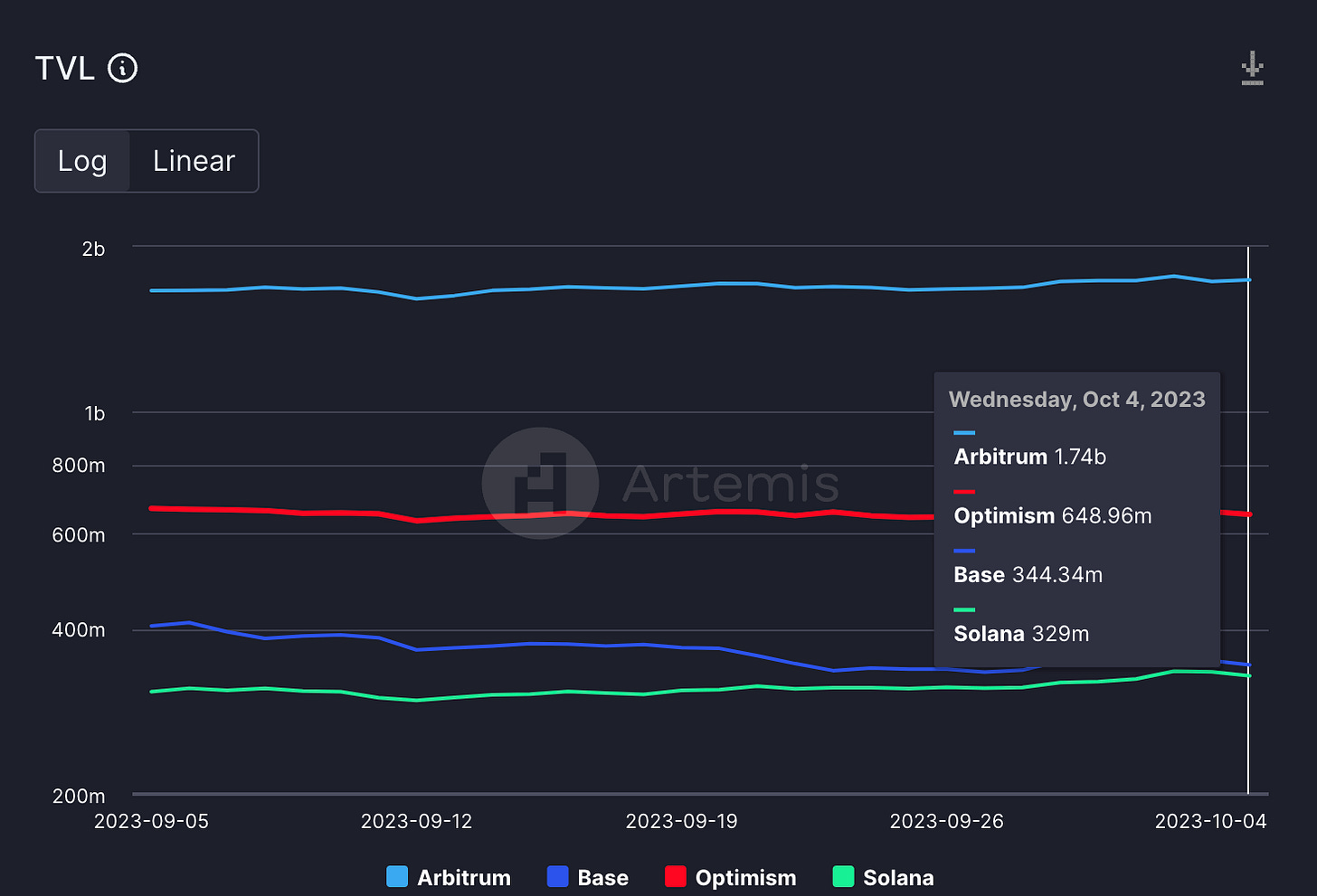

TVL on major Chains

The Total Value Locked in Arbitrum, Base, and Optimism remains higher than Solana's TVL.

Arbitrum: $1.74b

Optimism: $648.96m

Base: $344.34m

Solana: $329m

A Comprehensive Look at Next-Gen Leverage Trading with MUX Protocol

In recent months, MUX Protocol has experienced significant growth. This article aims to break down the essence of MUX Protocol, delve into the project's tokenomics, and provide on-chain analytics for a comprehensive understanding of the platform.

Today's Status ⚙️

Originally founded as MCDEX in 2019, the platform underwent a rebranding to MUX Protocol following the launch of MCDEX V3 in August 2022.

MUX Protocol is a decentralized Leveraged Trading Protocol. It offers features like zero price impact trading, up to 100x leverage, and an absence of counterparty risks for traders, ensuring an optimized on-chain trading experience. When engaged in leverage trading on MUX, traders transact against the MUX native pool.

The current live version on the mainnet, MUX Protocol V2, introduced the MUX Aggregator. We'll delve into the benefits of this aggregator later in the article.

MUX Protocol is supported on several chains including Arbitrum, BSC, Avalanche, Optimism, and Fantom.

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

MUX On-Chain Metrics 🧐

The chart below displays the Total Value Locked of MUX across all networks, as well as the price of MCB, the primary token on the platform. We'll discuss MCB further in the tokenomics section of this article. A notable observation from the chart is the apparent correlation between the TVL and the token price. This can be attributed to the utility of the MCB token within the protocol, a characteristic not always observed in other projects.

In the MUXLP pool, a total of $48,828,189 million is locked. This amount is particularly noteworthy considering the current bear market. It indicates a strong demand for derivatives projects. Currently, MUX holds the third position among top on-chain derivatives projects, trailing only GMX and DYDX.

At the time of writing this article, MUX Protocol has 18,058 unique users across all networks. While this number isn't exceptionally high, it's worth noting that some users might be using the same addresses multiple times. This metric deserves consideration since the liquidity appears to be distributed among a relatively small pool of users. It suggests there's potential for onboarding more users in the future. Moreover, it's important to remember that the current environment is a bear market. While I'm taking a long-term perspective when evaluating this project, this user count is definitely noteworthy. For comparison, GMX, another derivatives liquid protocol that launched much earlier than MUX, has 131,915 unique users across its network.

The Aggregator 🔗

When I delved into MUX Protocol, their aggregator truly stood out. It's addressing a pressing liquidity challenge inherent to on-chain derivatives platforms.

The derivatives sector is one of the fastest-growing segments in DeFi, and much of this surge can be attributed to the emergence of Rollups and other Layer 2 solutions on Ethereum. On Ethereum's mainnet, derivatives platforms face challenges due to their complex smart contract interactions which can rack up exorbitant gas fees. This makes frequent trading and smaller transactions costly and less efficient.

In contrast, Layer 2 solutions offer significantly higher throughput. This is crucial for activities like leverage trading which demands swift and numerous transactions. Additionally, the reduced latency on Layer 2 ensures quicker order execution and better user experience. In essence, while Ethereum's mainnet posed constraints for the growth of decentralized derivatives, Layer 2 solutions are providing the environment for them to truly flourish.

Liquidity Routing

When traders initiate positions on MUX, the MUX Aggregator actively compares trading prices across a range of leveraged trading protocols. Based on this comparison, the Aggregator then suggests the protocol that offers the most appropriate liquidity depth.

Think of the liquidity routing in the same vein as how 1Inch aggregates liquidity from various DEXs.

The MUX aggregator currently consolidates liquidity from MUX, GMX V1 and V2, and Gains Network. This makes it highly efficient for traders seeking substantial liquidity across these markets.

Building on that concept, consider a scenario where a user initiates a $100M position using the MUX Aggregator. This aggregated position might be distributed as follows: $50M on protocol A, $30M on protocol B, and $20M on protocol C. A major challenge in liquidity aggregation is the potential for price discrepancies across different protocols. Merging positions with varying entry prices isn't straightforward for the MUX protocol. To navigate this complexity, the MUX Aggregator employs several strategies.

Leverage Boosting

Different trading protocols have their own Initial and Maintenance Margin requirements, which can affect leverage options. Even if a protocol has abundant liquidity, it might not always provide the desired maximum leverage.

How MUX Aggregator Optimizes This:

In leveraged trading, there are two key terms:

IM (Initial Margin): The minimum amount you need to open a position.

MM (Maintenance Margin): The minimum amount you need to maintain your open position. If your balance falls below this, your position might be liquidated.

Different trading protocols have their own IM and MM requirements, which can affect leverage options. Even if a protocol has abundant liquidity, it might not always provide the desired maximum leverage.

Leverage Boosting: The MUX Aggregator can offer additional margin from its Universal Liquidity Pool to increase the leverage for traders.

Fee Structure: When using the MUX Aggregator's services, traders incur a minimal 'leverage boost fee.' Additionally, traders pay a 'boost funding fee' every hour, which is based on the extra margin provided.

Liquidations: If a trader's remaining margin drops below the MM threshold, their position will be liquidated. After liquidation fees are considered, any remaining margin is returned to the trader.

Funding Fees: Alongside the underlying protocol's fees, the MUX Aggregator charges an hourly boost funding fee. This fee is calculated based on the extra margin and will be deducted from the trader's collateral.

An Example: On GMX, with a 0.1% position fee rate, IM of 2%, and MM of 1%, and on MUX with MM at 0.5%: If a trader opens a $10,000 position with 100x leverage, they only contribute $100 as margin. MUX supplements this with an additional $50 margin. The trader will also incur a $10 fee on GMX and a $1 MUX leverage boost fee. In the event of a position loss leading to liquidation, after deducting relevant fees, the trader receives back a remaining margin.

Cross-Chain Liquidity

In the realm of on-chain leveraged trading, liquidity and users are dispersed across multiple chains. To streamline the trading experience across these chains, the MUX Aggregator employs the MUX protocol's Universal Liquidity mechanism, enabling cross-chain liquidity aggregation.

Here's how it works: if a trader initiates a position on Chain A, the broker module can task the MUX Aggregator to execute this position on an underlying protocol within Chain B. This means traders can harness the liquidity of Chain B for their leveraged trades without directly accessing it.

This becomes particularly advantageous if, for instance, Arbitrum offers greater liquidity and more favorable arbitrage opportunities, but you're initiating a position on Optimism. By leveraging the MUX Aggregator, you can tap into the superior conditions on Arbitrum without needing to shift your operations there directly.

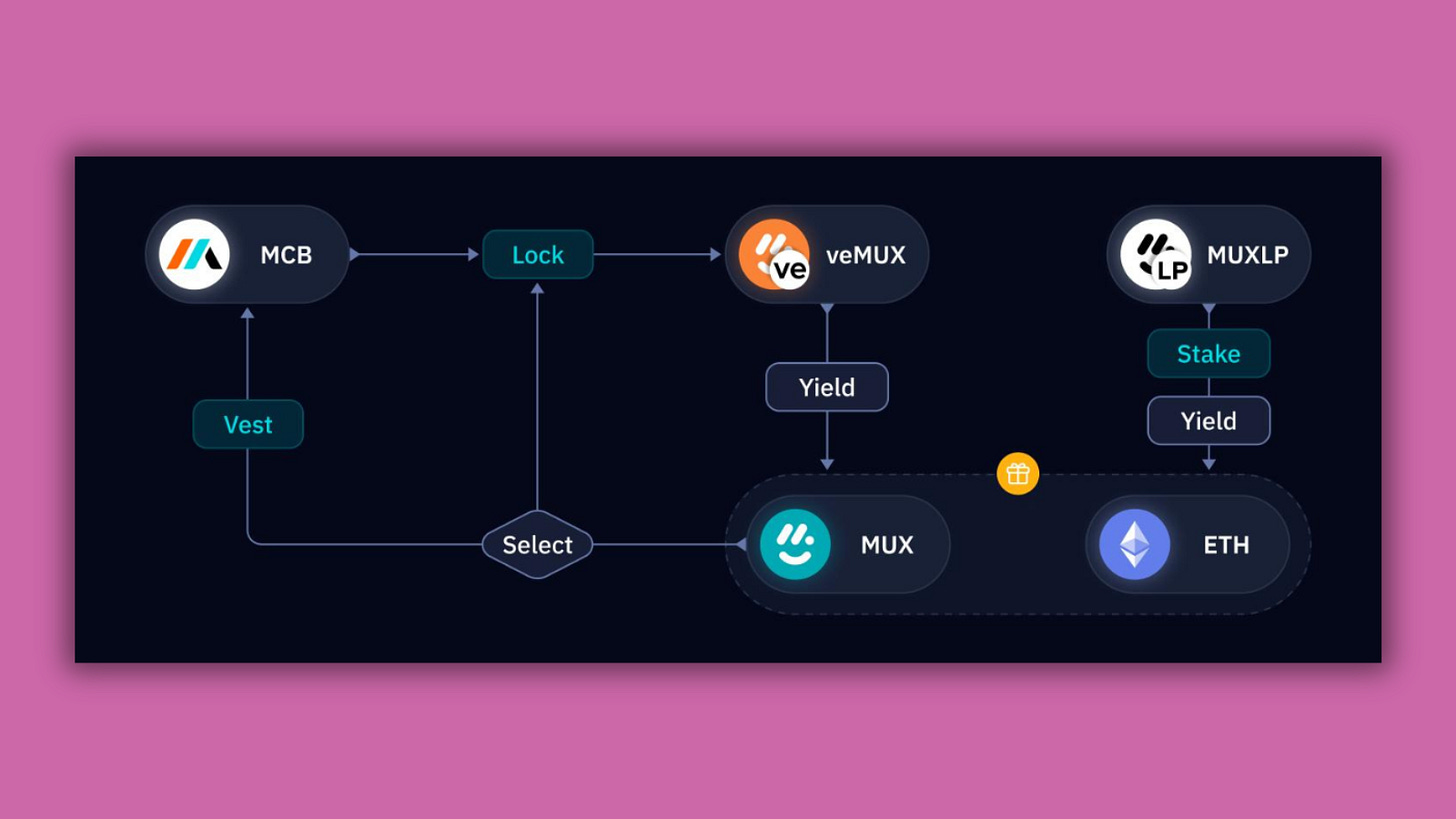

The Tokenomics 💰

The MUX protocol encompasses four distinct tokens that seamlessly integrate within its ecosystem.

1. MCB Overview

Role in Ecosystem: MCB serves as the primary token for the protocol.

Trading Platforms: MCB is actively traded on Arbitrum and the Binance Smart Chain.

Current Statistics (as of this article):

Trading Price: $9.28

Total Supply: 4,803,143 tokens

Market Capitalization: $35,752,417

Reserve and Vesting: 1,000,000 MCB tokens are earmarked for future MUX vesting.

Supply Cap Governance: The protocol's documentation states that the supply cap remains static unless a governance proposal, aimed at increasing it, is successfully proposed and accepted. Any approved alteration to the supply cap would then come into play after a 14-day time lock.

Staking and Locking Mechanism: Users have the flexibility to lock their MCB and/or MUX tokens to acquire veMUX. The duration for this lock can range anywhere from 2 weeks up to 4 years. Importantly, this locked-staking is time-weighted; longer durations for locks are reciprocated with a greater distribution of veMUX. Here's a breakdown:

1 MCB or MUX locked for 2 weeks yields 0.009589 veMUX.

1 MCB or MUX locked for 1 month yields 0.020548 veMUX.

1 MCB or MUX locked for 1 year yields 0.25 veMUX.

1 MCB or MUX locked for 4 years yields 1 veMUX.

2. MUX Overview

MUX stands as the non-transferable reward token within the MUX Protocol.

Acquisition: Users can accumulate MUX either by holding veMUX or through staking MUXLP.

Utility:

Staking: MUX tokens can be staked to acquire veMUX.

Vesting: Alternatively, MUX tokens can be vested into MCB.

Supply Dynamics:

Current Cap: MUX has a current supply cap of 1,000,000 tokens.

Daily Emission: 1,000 MUX tokens are emitted daily.

Vesting Impact: If MUX tokens are vested into MCB, the supply diminishes. This vesting procedure spans one year.

Governance Control: The MUX supply will remain unchanged unless a governance motion is presented and subsequently approved. Should the supply cap get a nod to be enhanced, this amendment would materialize post a 14-day time lock.

Locked-Staking:

Staking Rules & Rewards: The regulations and reward distribution for staking MUX parallel those for staking MCB.

Vesting Procedure:

MUX tokens can be vested into MCB linearly over a year. This can be done via two channels:

Quota Channel: Vest MUX based on the quota, which is influenced by veMUX. As veMUX spawns new MUX, the quota augments and shrinks when MUX transforms into MCB.

Capacity Channel: Vest MUX based on the capacity, ascertained by users' earmarked MUXLP tokens. This capacity remains static as long as the earmarked MUXLP tokens stay staked.

3. veMUX Overview

veMUX serves as the protocol's governance token.

Utility:

Governance Influence: Holding a higher quantity of veMUX amplifies a user's voting power in protocol governance decisions.

Income & Rewards: Possession of veMUX entitles users to both protocol income and MUX rewards.

Acquisition: Users can amass veMUX by locking in their MCB and/or MUX tokens.

Token Dynamics:

Minting & Burning: veMUX tokens are produced when users lock their MCB and/or MUX. As the lock duration dwindles, these tokens get burnt.

Transferability: veMUX tokens cannot be transferred.

Network: They are exclusively available on the Arbitrum network.

Rewards:

Allocation: Trading fee revenue generated by the protocol is apportioned to veMUX token holders.

4. MUXLP Overview

MUXLP represents the protocol's liquidity provider

Acquisition: Users can acquire MUXLP using assets approved by the pool's portfolio.

Utility:

Income & Rewards: After purchasing MUXLP tokens, users can stake them to qualify for protocol income and MUX rewards.

Rewards:

Allocation: Trading fee revenue is earmarked for MUXLP stakers. Delve deeper into the Incentives section for comprehensive details.

Token Dynamics:

Minting & Burning: MUXLP tokens are spawned upon fulfilling buy orders and annihilated when sold.

Supply Cap: There isn't a defined upper limit for MUXLP tokens in circulation.

The Leveraged Trading Platform 🔗

In addition to the Aggregator, MUX has its own leveraged trading platform with an impressive user interface similar to what one might encounter on GMX or DYDX.

On the MUX Leveraged Trading platform, traders can leverage their positions up to 100x. Thanks to the aggregated liquidity we discussed earlier, the platform benefits from deep liquidity, ensuring optimized capital efficiency.

As we touched upon in the tokenomics section, liquidity providers can supply liquidity, obtain MUXLP tokens in return, and then stake these tokens to earn protocol income and MUX token rewards.

Final thoughts 🧠

Given its innovative developments, liquidity across various L2s, and a strong token performance, it's evident why MUX ranks as one of the top protocols in the derivatives category.

The team behind MUX appears to be highly competent, making it a noteworthy addition to my portfolio, especially anticipating the upcoming bull market. During such market phases, speculation typically peaks, and many users might lean towards on-chain derivatives to take positions on assets like ETH.

MUX's market cap stands distinctly lower than competitors like GMX or DYDX, indicating significant growth potential. This potential is further bolstered by the token's limited supply and well-conceived tokenomics.

While I seldom engage in active trading, I prefer using MUX when I do, primarily because of their aggregated liquidity feature.

I'd love to hear your thoughts on MUX Protocol. If there's anything you believe I might have overlooked, please share in the comments below.

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose