Weekly Alpha #16: Ditch Big Exchanges & Embrace Freedom 🌉

Latest DeFi Alphas Delivered in a Concise Newsletter.

Welcome to the latest edition of Weekly Alpha.

Every Friday, I deliver insights on the cryptocurrency market, emerging projects, macroeconomic trends, and DeFi directly to your inbox.

Your Weekly DeFi News Digest 🗞️

In this section, I highlight the week's most impactful DeFi news. This way, you can bypass the chatter on Twitter and concentrate on the essential updates.

Aztec advances privacy product roadmap with test environment launch

Bitcoin’s first zero-knowledge light client seeks to drive innovation

Unclaimed ARB Tokens Worth $56M Returned To DAO

Eclipse takes a ‘best of all worlds’ approach to solve scalability trilemma

GHO ‘cannot maintain its peg’ without changes, says researcher

Deep Dive into MetaMask Snaps with Erik Marks

Ethereum OFAC compliance dips to 45% post-Merge upgrade

Friend.tech copycats eager to capitalize on social finance craze

ArbitrumDAO and Foundation Offer Grant Support for Builders on Arbitrum

Ledn Launches Support For ETH Staking Yields

Devnet, testnet, mainnet: Ethereum’s next upgrade progresses — slowly

Alpha Yield Opportunities 👩🌾

If you're looking for the best yield opportunities, I've curated them for you in this section.

Beefy Finance (Arbitrum) - 32.07% APY on the cbETH/wstETH/rETH vault

KyberSwap (zkSync Era) - 15.64% APR on the USDC - USDT pool

Extra Finance (Optimism) - 84.2% APY on the USDC-wUSDR pool (leverage)

Stargate Finance (Base) - 5.21% APY on the USDC farm

BaseSwap V2 (Base) - 12.83% APY on the DAI-USDC pool

DeFi market overview 📈

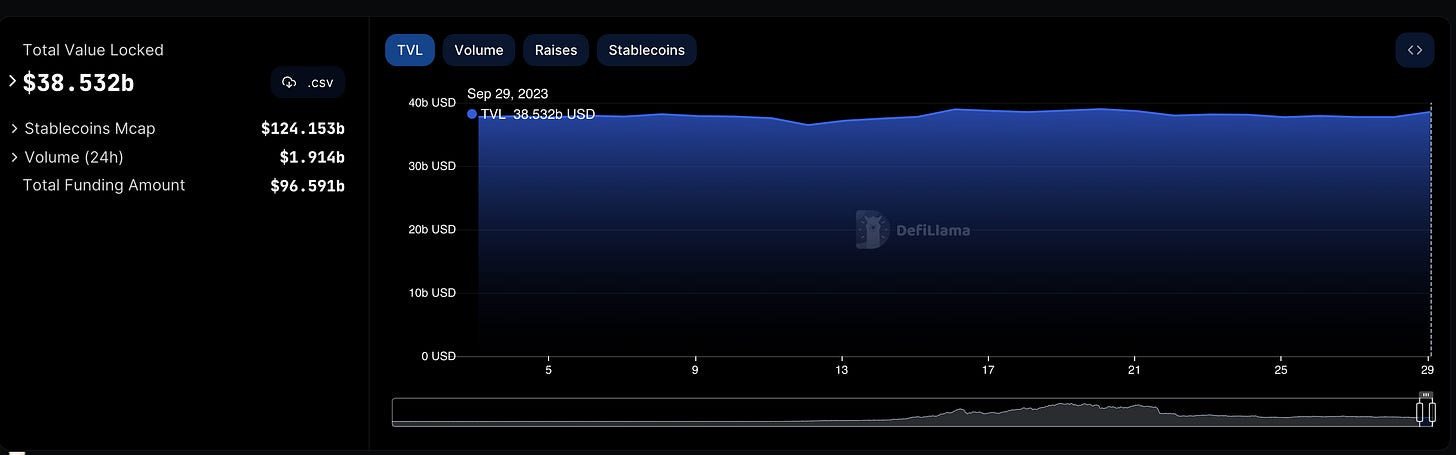

Total TVL

The current TVL across protocols stands at $38.532 billion, showing a modest increase from last week's $38.054 billion. While the market has somewhat recovered from last week's dip, we are still significantly below the $100 billion level observed in 2022.

Leading Protocols Ranked by Revenue

Over the past 7 days, Friend.Tech has performed exceptionally well in terms of revenue. It currently ranks just behind Tron and ahead of MakerDAO and Lido. This is particularly impressive considering that Base has been live on the mainnet for approximately 2 months.

Market Capitalization of Stablecoins

The market capitalization for stablecoins in the DeFi sector has been steadily declining. Currently, there's limited demand for on-chain applications. As inferred from the chart below, we may be nearing a bottom, especially with the year drawing to a close.

The potential approval of BTC ETFs could inject liquidity, and the development of more robust infrastructure like L2 solutions will be invaluable for onboarding newcomers in the next cycle. Furthermore, Account Abstraction applications will represent a significant improvement over the EOA accounts currently in use.

A Compact Guide to Reducing Dependence on Banks and Centralized Exchanges

I've encountered more problems with banks concerning on/off-ramping than I have with centralized exchanges like Coinbase. Over the years, centralized exchanges have served me exceptionally well for buying and selling crypto. I firmly believe that as long as you're not engaging in illegal activities based on your jurisdiction, banks shouldn't question your financial transactions unless they have strong suspicions.

It's worth noting that in 2022, only 0.24% of all cryptocurrency transactions were linked to illicit activities. Contrary to popular misconceptions, criminals rarely use crypto.

However, the reality remains that even for those involved in crypto, especially in the West, we still rely on bank accounts to manage taxes and other bills.

Ever since I began accumulating crypto a few years ago, I've been trying to reduce my dependence on centralized exchanges and banks. For instance, I use Coinbase strictly for onboarding and offboarding. I avoid trading on Coinbase. Most of the time, when I offboard, it's primarily to handle my investment taxes. Recently, I've been reducing my onboarding on Coinbase in favor of a non-KYC exchange, which I'll delve into in this guide. Keep reading if you're intrigued!

In this guide, I'll share a list of tools that I've either personally used or come across to reduce dependence on centralized exchanges and banks. If you're looking to gain more autonomy from these platforms, this guide is for you. Even if you prefer traditional banks and centralized exchanges, you might find some intriguing tools to enhance your crypto spending or earning.

Bitrefill: Spend Crypto with Ease

When it comes to spending crypto without undergoing KYC and maintaining my privacy, I've relied on Bitrefill for several years.

Bitrefill allows users to spend crypto by directly purchasing gift cards through on-chain transactions. I've personally used it with the Lightning Network and Ethereum. Through Bitrefill, I've bought flight tickets, Amazon gift cards, Starbucks vouchers, food, and much more.

Bitrefill operates in many countries. So, chances are, if you're reading this newsletter, you can make purchases using their service.

Whenever I travel, I buy some Bitrefill gift cards, which always gives me a sense of financial freedom.

If you'd like to try it out, you can use my affiliate link. When you spend $50, you'll receive $5 in Bitcoin – it's a win-win for both of us.

For those based in Europe, Bitrefill is also introducing Apple Pay and Google Pay cards, which you can top-up using BTC, ETH, USDC, USDT, and other cryptocurrencies up to 15,000 EUR/month.

You can join the waitlist now for the beta version.

Mt Pelerin: The Swiss gateway to the crypto world

This particular option is intriguing, but it's unfortunately not available in the U.S.

Mt Pelerin serves as an ideal bridge between your bank account and your wallet. It enables you to purchase Ethereum, Bitcoin, and other major cryptocurrencies without undergoing KYC or surrendering your private key to a third party. When you make a purchase using your bank account in EURO or CHF, the cryptocurrency is directly transferred to your non-custodial wallet.

The exchange is regulated, based in Switzerland, and has maintained an excellent track record since 2018.

As an Ethereum power user, I particularly value that Mt Pelerin already supports Layer Two solutions like Optimism and Arbitrum.

Each year, the first CHF500 (or its equivalent) that you exchange with MT Pelerin via bank transfer is completely free!

The exchange provides a non-custodial wallet that's available on both the App Store and Google Play Store. However, you also have the option to use your own hardware device, such as Ledger, your Metamask account, or any other wallets.

Moreover, they offer a feature to pay your bills with crypto. As I mentioned earlier, this isn't some obscure, anonymous exchange – it's a regulated platform with a transparent team behind it.

If you're seeking a straightforward method to convert cash to crypto, or transition from crypto to fiat, Mt Pelerin might be an excellent choice.

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

DeWork: Complete Tasks and Earn Crypto.

If you're keen on reducing your dependence on traditional bank accounts and centralized exchanges, DeWork is a fantastic platform to earn crypto.

As a developer, I can complete tasks for DAOs like BanklessDAO and other well-known DAOs, receiving payment in governance tokens, stablecoins, or other ERC-20 tokens across EVM blockchains.

Whether you're a developer, designer, writer, or another professional, there are plenty of tasks available on DeWork. Best of all, you don't need to register, go through KYC, or seek permission to monetize your skills.

The website interface resembles a Jira board, so if you're familiar with that, navigating DeWork should be intuitive.

Once you've completed a task and it's approved by the DAO, you receive tokens as payment.

The platform hosts a variety of tasks, both small and extensive. I believe this is an essential resource for freelancers, especially with the anticipated bull market, as more projects will be on the lookout for contributors.

If you're a content creator or have an open-source app and are considering outsourcing tasks, DeWork can also be an excellent solution for you.

Conclusion

There are many alternatives to decrease reliance on centralized exchanges and the traditional banking system. It's beneficial to be aware of all the available solutions and to prepare in case of potential regulatory actions against your crypto holdings or even a collapse of the banking system.

Although a banking system collapse doesn't seem imminent—given that many major countries have historically bailed out banks—we can never truly predict the future.

If you have tools that you love using, please share them in the comments section or on Twitter. I'm always eager to discover new tools.

Wrapping up for this week. For daily DeFi updates, follow me on Twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose