Weekly Alpha #12: Artemis Analytics 🧐

Latest DeFi Alphas in a Short, Packed Newsletter.

GM.

Every Friday, I curate and deliver the most impactful DeFi news and the hottest yield opportunities straight to your inbox.

Weekly DeFi news 🗞️

DeFi Sector Increasingly Sees Real-World Assets As Growth Area

DeFi LPs Turn To Liquidity Managers To Tackle Uniswap V3 Complexity

Aave Launches sDAI Pool As MakerDAO Weighs Reducing Yields

Farcaster To Migrate From Ethereum To Optimism Superchain

Ethereum staking services agree to 22% limit of all validators

Aerodrome Fanatics Deposit $150M to Base Blockchain on First Day

PancakeSwap Version 3 Goes Live on Ethereum Layer 2 Linea Mainnet

Pendle Finance Users Can Now Profit From Real World Assets

Alpha Yield Opportunities 👩🌾

PancakeSwap (Ethereum mainnet) - 154% APY on the on TUSD/USDT pool

Pearl Exchange (Polygon) - 31% APR on the USDC/USDR pool

Beefy Finance (Optimism) - 44.48% APR on the USDC-wUSDR vLP V2 vault

Reactor Fusion (zkSync Era) - 2.66% net APR when depositing ETH

Convex Finance (Arbitrum) - 4.04% APR on WBTC/tBTC pool

DeFi market overview 📈

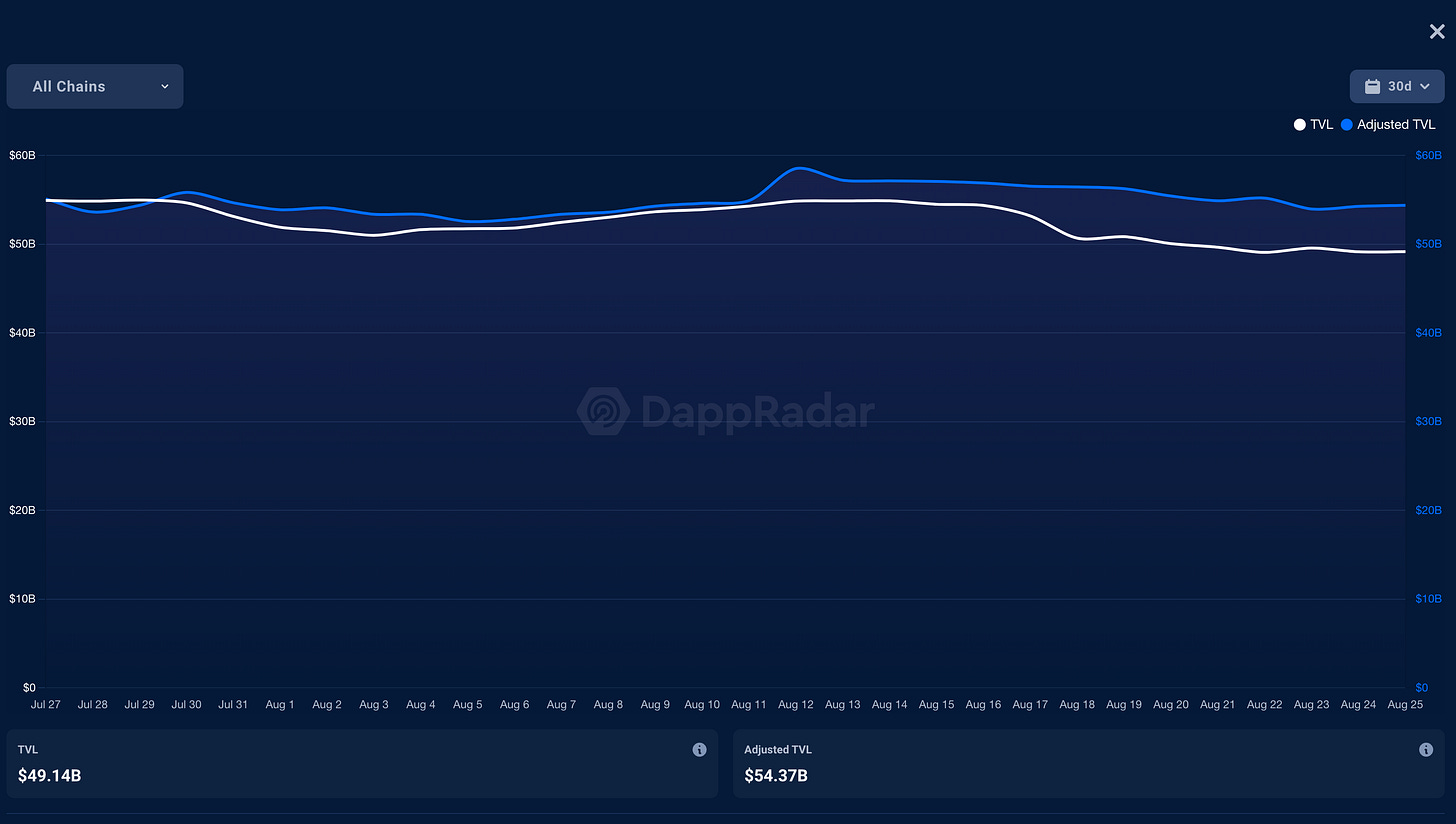

Similar to last week, the total value locked (TVL) in DeFi is currently relatively stable, hovering around $49 billion.

In my opinion, this stability is good news, especially considering that we are in a bear market where most assets are experiencing slow and flat declines. This sets the stage for potential growth in the upcoming bull market.

On the Layer 2 front, zkSync Era continues to lead in terms of weekly active addresses. As I mentioned in the tweet below, this is primarily attributed to airdrop farming at the moment.

Analytics spotlight 🧙♀️

When conducting research, I also make it a point to focus on non-EVM (Ethereum Virtual Machine) chains like Solana or NEAR Protocol to see if there's any activity that I may have overlooked. Since I'm not actively involved in those ecosystems, I believe it's crucial to keep them on my radar and strive to stay current.

To assist with this, I use Artemis Terminal, which offers a plethora of metrics for tracking both EVM and non-EVM chains. It's an invaluable tool for anyone interested in DeFi research.

What is Artemis Terminal?

Artemis serves as an institutional data platform for digital assets. They source, transform, and aggregate blockchain data, converting it into streamlined insights for their users.

How to use Artemis Terminal?

If you're conducting DeFi research, Artemis allows you to effortlessly create dashboards using their no-code tools. For example, in the image below, I'm comparing the Daily Active Users between Ethereum and Solana.

The chart builder tool is extremely intuitive and easy to use, even if you have no programming experience.

What I also appreciate about Artemis is its capability to monitor market performance beyond the crypto space, including traditional indices like the S&P 500, gold, or the Nasdaq.

Overall, Artemis is a simple yet highly effective tool for conducting on-chain analysis. While it may not be as modular as Dune Analytics, it is certainly my go-to tool for handling straightforward data.

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

Currently, I'm using the Free version, but there are also Pro and Enterprise plans available if you're interested in accessing additional metrics, trying out sheets, or downloading unlimited CSV files.

Let me know in the comments below what you think of Artemis Terminal

That's it for this week. I hope you enjoy this new format. I will continue to share alphas and news each week, so don't hesitate to subscribe to the newsletter.

Support me:

🫡 Follow me on Twitter for DeFi insights: https://twitter.com/yanneth_eth

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose