Weekly Alpha #11: Layer 2 Analytics with GrowThePie 🥧

Latest DeFi Alphas in a Short, Packed Newsletter.

GM.

Every Friday, I curate and deliver the most impactful DeFi news and the hottest yield opportunities straight to your inbox.

Weekly DeFi news 🗞️

Ethereum Layer 2 Throughput Hits Record High

Balancer has discovered a critical vulnerability that has affected a number of V2 Pools within its ecosystem.

Coinbase Invests In USDC Issuer Circle

EigenLayer Pulls In $160M Of Deposits Within Two Hours

dYdX Declares War On MEV Ahead Of Appchain Migration

Tornado Cash developer Roman Storm released on bail, lawyer says

Num Finance launches Colombian peso stablecoin on Polygon

Uniswap Spot Volume Surpassed Coinbase In 2023

Farcaster To Migrate From Ethereum To Optimism Superchain

Alpha Yield Opportunities 👩🌾

Pendle Finance (Arbitrum) -11% APY on the on GLP

Radiant Capital (Arbitrum) - 1.27% APY on WETH deposits

Stargate Finance (Arbitrum) - 3.28% APY on USDC farming

Extra Finance (Optimism) - 77.4% APY on USDC-wUSDR farm

Velodrome Finance (Optimism) - 6% APR on the USDC/sUSD pool

DeFi market overview 📈

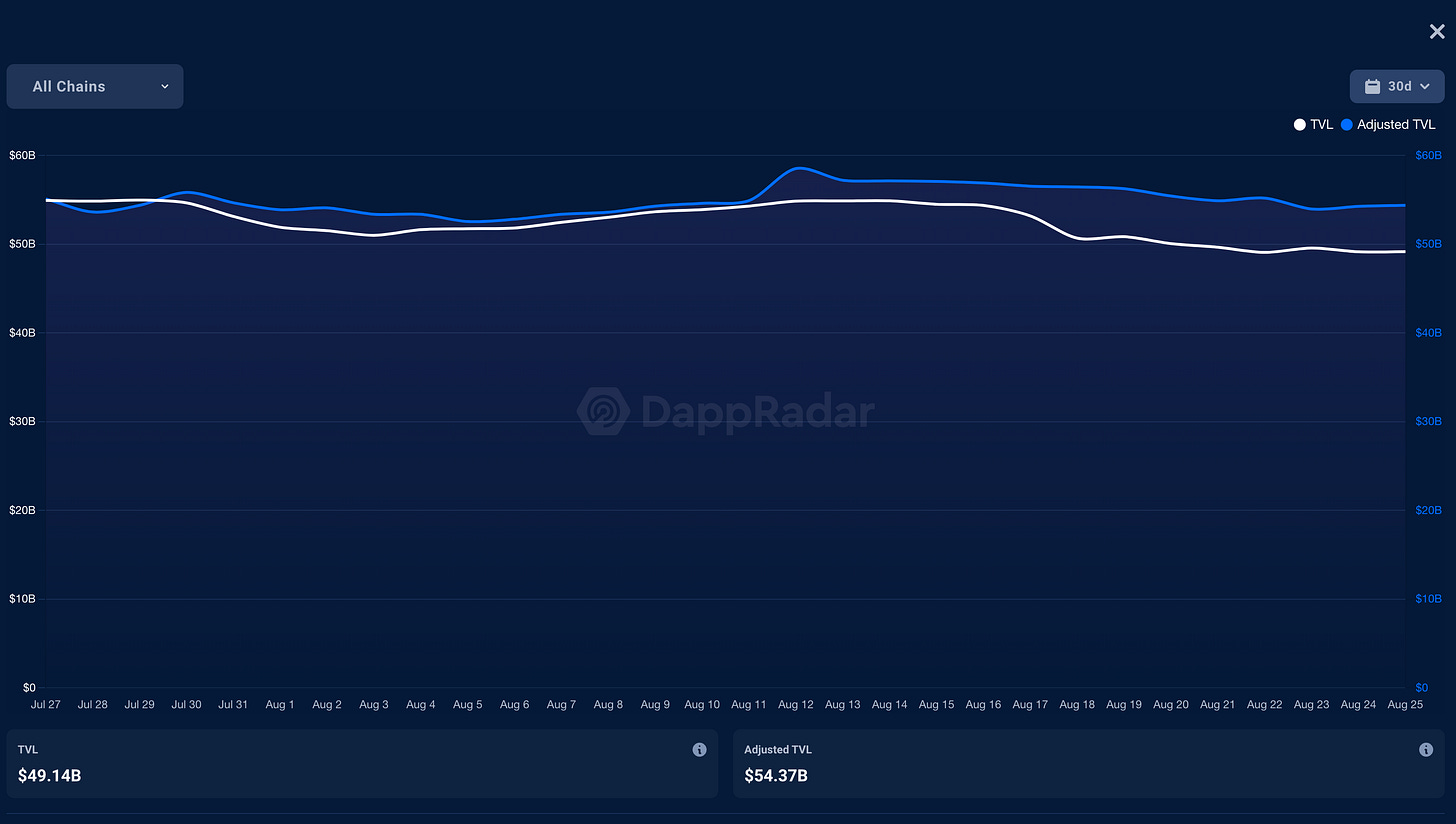

This week, DeFi TVL experienced a slight downturn once again like the broader Crypto market

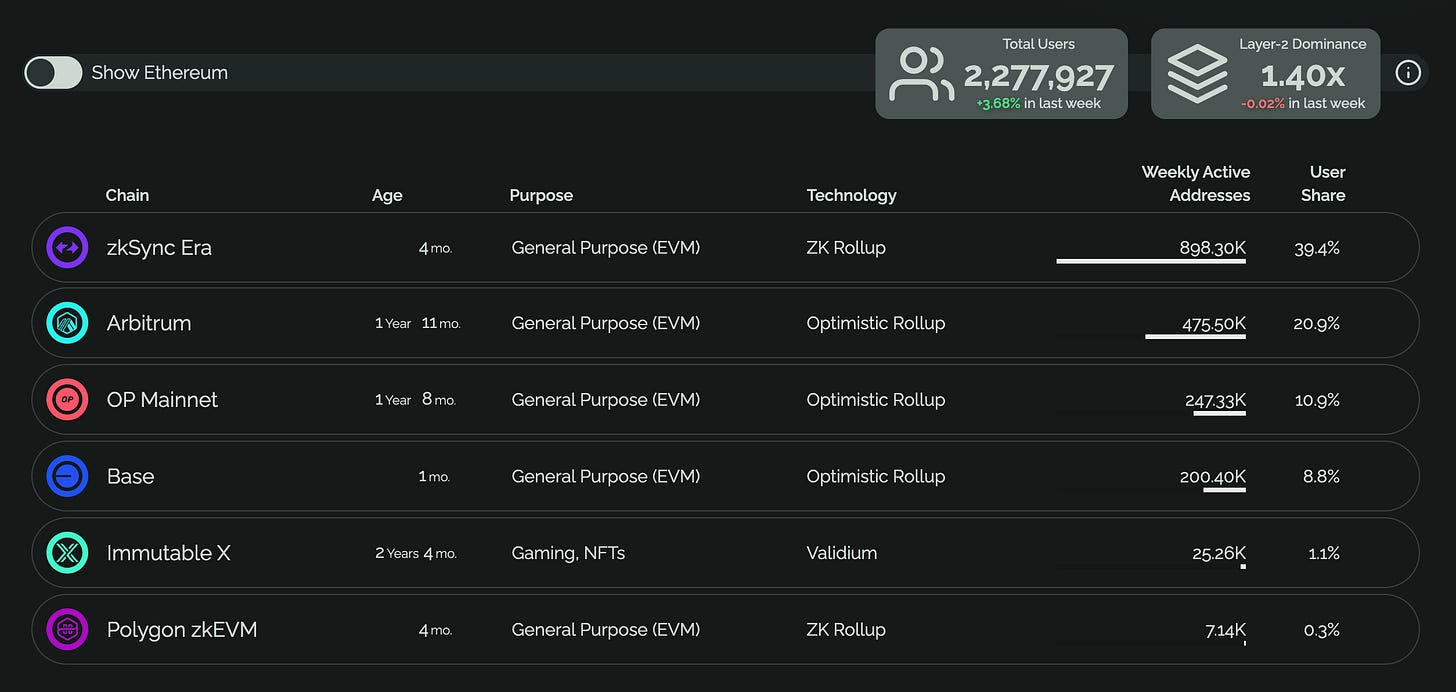

In terms of Layer 2’s economy we are seeing an up trend for the month of august in terms of total users.

Similar to the daily active addresses, Layer 2’s are really health and we can see an increase in most of the chains

Analytics spotlight 🧙♀️

Drawing from multiple websites and having the ability to audit open-source code are crucial factors for me in conducting DeFi analytics research.

This week, I'd like to introduce you to GrowThePie, a cutting-edge Layer 2 analytics tool. Not only is it open-source, but it also offers compelling metrics that I regularly incorporate into my daily research.

What is GrowThePie?

GrowThePie is a data platform established as a public good, focusing specifically on Layer 2 scaling solutions. The platform offers detailed analyses of both basic metrics and intricate blockspace usage, organized within a carefully curated set of categories.

The primary objective of GrowThePie is to empower both developers and users. To achieve this, it provides a comprehensive overview of critical metrics, on-chain data, and educational resources. These features are designed to help individuals make informed decisions when selecting an L2 chain on which to build.

By using the resources provided by GrowThePie, users can acquire both a fundamental understanding of L2 chains and a deeper insight into how blockspace is utilized in real-world scenarios. This multi-faceted approach gives a more complete picture, ensuring that users have all the information they need to make the best decisions for their specific needs.

How to use GrowThePie?

GrowThePie offers a wealth of on-chain data for comparison, including metrics like daily active addresses and transaction counts. To access this information, visit the platform's frontend interface. Once there, you can easily filter the data by clicking on a specific chain. This allows you to view and analyze metrics in a straightforward and intuitive manner.

As indicated in the image above, GrowThePie offers the ability to filter data by date and even remove specific chains from the analytics dashboard. For instance, you could choose to compare metrics between OP Mainnet and Arbitrum by selecting these options. This filtering capability is available for all the metrics provided on the platform, allowing for a customized analytics experience.

Metrics available

Transaction Count

Daily Active Addresses

Transaction Costs

Total Value Locked

Fees Paid By Users

Stablecoin Market Cap

Chain Tracked

Base

zkSync Era

Arbitrum

Immutable X

Polygon zkEVM

Ethereum

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

That's it for this week. I hope you enjoy this new format. I will continue to share alphas and news each week, so don't hesitate to subscribe to the newsletter.

Support me:

🫡 Follow me on Twitter for DeFi insights: twitter

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose