Weekly Alpha #10: Maverick Protocol Boosted Yield 🏄♂️

Latest DeFi Alphas in a Short, Packed Newsletter.

GM.

Every Friday, I curate and deliver the most impactful DeFi news and the hottest yield opportunities straight to your inbox.

Weekly DeFi news 🗞️

Curve Finance vows to reimburse users after $62M hack

Visa Tests Way to Make Paying Ethereum Gas Fees Easier

Is Friend.tech a Friend or Foe? A Dive Into the New Social App Driving Millions in Trading Volume

Aave’s GHO Stablecoin Consistently Trades Under Dollar Peg

Base Activity Surges After Public Launch

Zunami Protocol confirms stablecoin pools attacked, $2.1M loss estimated

CRV Emissions Drop By 16% As Token Turns Three

Uniswap Worker Fired for Rug-Pull Dispute of 14 ETH Memecoin

Polygon’s Fee And Transaction Volumes Diverged In Q2

Immutable zkEVM begins testnet phase with 12 Web3 games in development

Paypal USD (PYUSD) Will Soon Be Available on Changelly

Base project RocketSwap shares emergency plan following $865K exploit

Linea Completes Public Mainnet Rollout

Binance To Launch opBNB Layer 2 Network Later This Month

PayPal Teams Up With Ledger On Fiat Onramp For US Users

Wintermute Proposal To Borrow YFI Draws Fire From DeFi Community

Bitcoin Hits Two-Month Low Under $28,000

Alpha Yield Opportunities 👩🌾

THORSwap (Thorchain) - 747% APY on the BTC-RUNE Pool

Velodrome Finance (Optimism) - 56% APY on the USDC-VELO pool

Beefy Finance (Polygon zkEVM) - 10.28% APY on the rETH-ETH pool

Vela Exchange (Arbitrum) - 41% APR on USDC staking

Instadapp (Mainnet) - 11.99% APR on ETH

DeFi market overview 📈

Much like the broader crypto market, DeFi experienced a downturn this week, with a TVL of $50.7 billion, as reported by DappRadar.

Currently, there doesn't seem to be an influx of fresh capital; rather, the same funds appear to be circulating across various protocols. While we can't be certain, I'm skeptical that we'll see significant growth in terms of TVL (Total Value Locked) anytime soon.

One insight I've gained during the latter half of this bear market is the rise of impressive protocols on Layer 2 and App chains. I firmly believe that these will drive narratives to attract new users seeking lower fees and faster transactions. As much as I might dislike admitting it, BNB successfully introduced many newcomers to the space, with protocols like Pancake Swap serving as a prime example.

Analytics spotlight 🧙♀️

Filtering the noise in Crypto is really important, if you want to play the long-term game and not burn your funds before the bull market is coming, you need to play right.

One of my strategy is to use DeFi protocols with a chunk of my portfolio and accumulate yield while we are in a bear market.

In this guide, I’ll show you how to find the best yield opportunities on DeFiLlama with pools that has a fairly high TVL and the protocol being reputable.

First, navigate to the DeFiLlama website and click on the 'Yield' tab. This will take you to a table where you can view all the yield pools indexed by DeFiLlama.

When you're on the Yield ranking page, you can begin filtering by TVL. If you're unfamiliar with TVL, it stands for 'Total Value Locked.' In this context, it refers to the TVL of the pool. Filtering by TVL is useful because a substantial TVL often indicates that a project is reputable, especially when considering investments in exotic governance tokens. However, a significant TVL doesn't guarantee the absence of risk!

Referring to the aforementioned screenshot, I'm focusing on pools with a TVL of at least $5 million. This threshold is set low enough to identify pools with high APY, yet high enough to ensure a basic level of reputability.

After applying the filter, click on the 'APY' button to sort the yields from the highest to the lowest.

Now, you'll be able to view high-yield opportunities across all EVM chains. You also have the option to filter by stablecoins or single-sided pools. However, if you're considering investing in a volatile pool, always be mindful of impermanent loss.

Use Bitrefill to live on crypto without resorting to centralized exchanges.

They offer hundreds of gift cards and are accessible worldwide. 🌎

Protocol highlight 🦄

Each week we talk about a DeFi protocol that is changing the game and adding great value to the ecosystem.

This week, we are covering Maverick Protocol

Category: DEX

Token Ticker: MAV

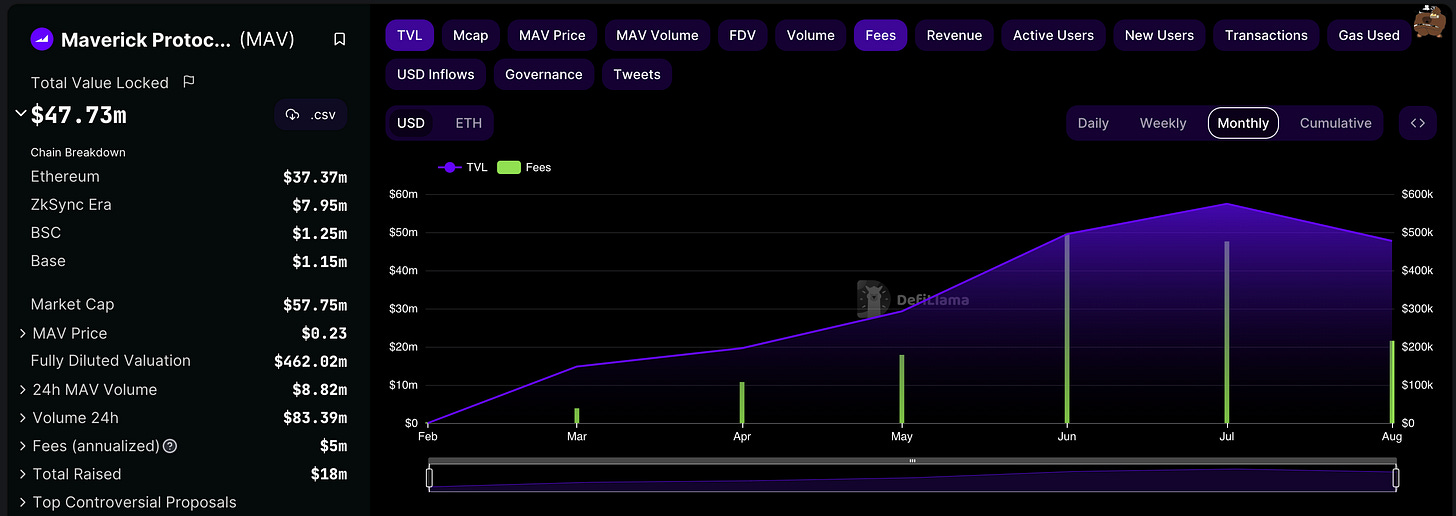

TVL: $47.73m

Networks: Ethereum | ZkSync Era | Base | BSC

What is Maverick Protocol?

Maverick Protocol offers a new infrastructure for decentralized finance, built to facilitate the most liquid markets for traders, liquidity providers, DAO treasuries, and developers, powered by a revolutionary Dynamic Distribution Automated Market Maker (AMM).

Overview

Overall, Maverick TVL is steadily growing across all chains that it is deployed to, most of the liquidity locked is on Ethereum mainnet followed by zkSync Era.

Maverick Protocol narratives

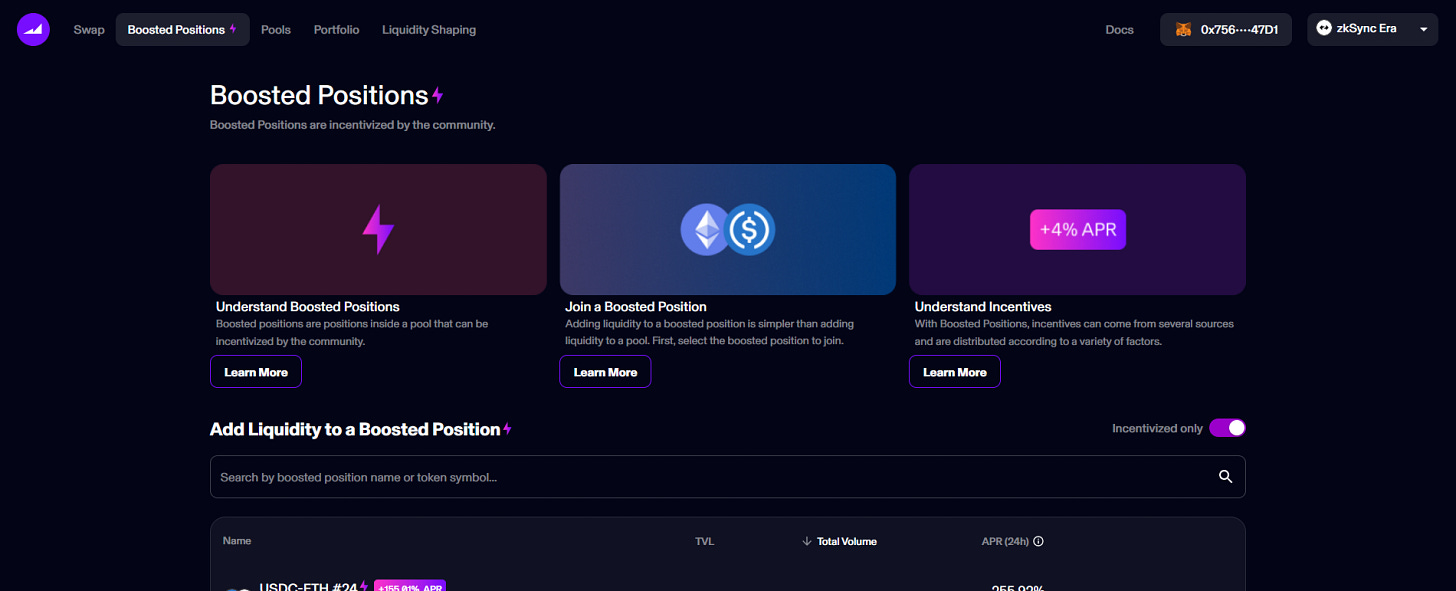

What particularly piqued my interest in Maverick protocol was when I learned about the "Boosted Position" mechanism.

To grasp the fundamentals of the Boosted Position, you can delve into the basic concepts provided in the Maverick documentation.

Any user can add incentives to any Boosted Position on Maverick. You do not have to be the creator of a Boosted Position in order to add incentives to it.

That's it for this week. I hope you enjoy this new format. I will continue to share alphas and news each week, so don't hesitate to subscribe to the newsletter.

Support me:

🫡 Follow me on Twitter for DeFi insights: https://twitter.com/yanneth_eth

None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose