Exploring Aerodrome Finance: The Yield Engine On Base Network 🔵

A Dive into Aerodrome Finance: Build a passive income stream on Base.

I’ve been passionate about AMM and this new economy for a long time. From Uniswap V1 to now, the AMM field has evolved significantly. New and interesting tokenomics are being created and upgraded. It has never been easier or cheaper to generate passive income from on-chain activity if you are patient.

In 2024, Layer 2 scaling solutions like Base drastically reduce gas fees compared to the Ethereum mainnet.

In the past, transactions on the Ethereum mainnet were more accessible due to the low price of ETH and relatively low gwei. For example, in 2020, one of my Uniswap trades cost me only $0.42. Today, that same transaction would cost roughly $7.

What is Aerodrome Finance?

Aerodrome Finance is an AMM on Base, inspired by Solidly. It inherits architecture and security maintenance from Velodrome V2. There are four important components of Aerodrome Finance that we will discuss in this article:

1. Voting

2. Trades

3. Emissions

4. Rewards

Voting: As an $AERO token holder, you can lock your tokens for up to 4 years. The duration impacts your voting power. Once you lock your $AERO tokens, you receive $veAERO, represented as an NFT. This NFT can be traded on the secondary market or bought if you prefer not to lock your tokens.

Holding a $veAERO NFT gives you governance power to establish rewards for trading pairs. In return, you receive 100% of the fees and incentives generated by the pools you voted for, providing a great way to earn passive income.

Trading: Similar to Uniswap AMM, you can trade tokens on Aerodrome Finance. While there is no direct incentive for trading, the platform offers high liquidity and fast trade execution compared to the Ethereum mainnet. If you are reading this newsletter, you are likely familiar with Layer 2 solutions.

Providing liquidity on Aerodrome Finance is interesting. You can select stable or volatile pairs depending on your risk tolerance regarding token prices and impermanent loss. Research opportunities to find pools with high APRs and low impermanent loss to grow your portfolio.

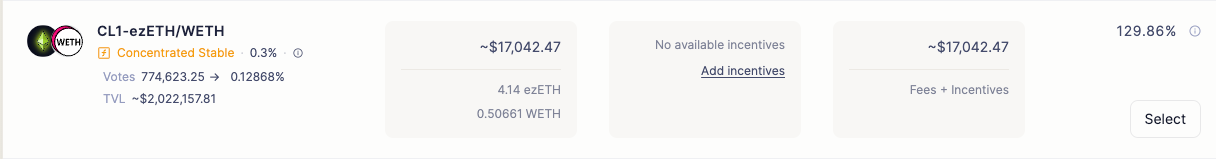

For example, one of my favorite pools is ezETH/WETH, which has relatively low impermanent losses and an APR of 24.86%.

In my opinion, this liquidity pool is a great play. It offers exposure to Renzo Protocol and EigenLayer points by holding ezETH. Additionally, you benefit from the Ethereum beacon chain yield, currently at roughly 3%, along with ETH in its wrapped version. If you are bullish on ETH, this is a great play in my book (Note: This is not financial advice).

Growth and Analytics

Since its inception in August 2023, Aerodrome Finance has grown substantially, generating and redistributing over $26 million in fees to veAERO holders

Although daily transactions have dipped slightly, cumulative transactions recently reached 1.5 million within less than a year. This is impressive growth for such a young protocol and aligns with the overall growth of the Base Network.

One interesting metric to follow is the average lock duration of veAERO holders. Personally, I locked mine for 4 years due to an airdrop for locking my VELO tokens on Optimism. Currently, the average lock duration is 3.89 years, indicating that most users are in it for the long term and bullish on AERO emissions.

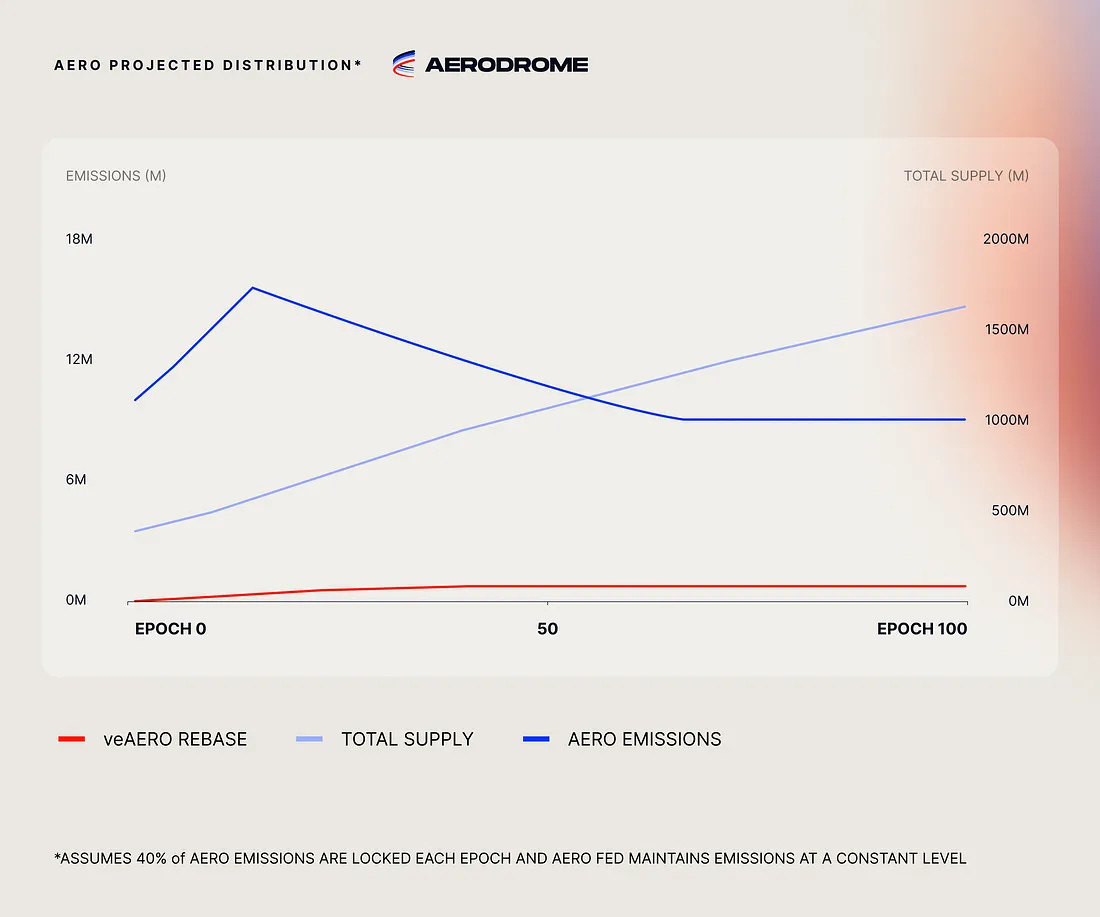

However, despite many AERO tokens being locked, the current inflation rate is fairly high.

This chart assumes that 40% of AERO emissions are locked at each epoch.

Aerodrome playbook

Voting Strategy: When you vote on Aerodrome Finance and lock veAERO, you receive rewards from the pool. The best strategy is to vote for pools with fundamentally strong pairs rather than worthless memecoins. Although those pools may offer high APRs, the tokens are more likely to become worthless once you receive your rewards

A good example is the ezETH/WETH pool, which currently has a voting APR of 129.86% if you are bullish on ETH. The voting period operates on an epoch basis, occurring every week. If you lock your tokens, set a reminder to manage your positions once a week to capture the best rewards and APR, as these can vary with each epoch.

Liquidity Provider Strategy: When you provide liquidity, you earn rewards on each swap that occurs on the AMM. A favored strategy is to provide liquidity in concentrated stable pairs that require minimal management, such as stablecoins. By providing liquidity, you can find great APRs even on stablecoins. However, ensure you avoid dark stablecoins that could depeg at any time, despite their high and tempting APRs.

Aerodrome Finance is a long-term game. After a few months, you will see your rewards start compounding. It’s better to lock your tokens for longer than 2 weeks if you are bullish long-term. This way, you gain more voting power and more rewards.

Disclaimer: None of the information in this newsletter constitutes financial advice. While I personally use most of the protocols that I discuss, it's important to understand that they involve substantial risk. Don’t invest what you can’t afford to lose.