Arbitrum's DeFi Landscape: Harnessing Yield Opportunities in a Vibrant Ecosystem

Exploring Innovative Protocols and Their Potential in the Post-Airdrop Era

Step into the energetic universe of Arbitrum's DeFi ecosystem. This thriving space hasn't missed a beat, even post-Airdrop. In this edition, I'll be your guide, showing you a handpicked range of Arbitrum protocols teeming with fantastic yield opportunities. So, get ready and join me on this engaging exploration; it's time to broaden our horizons and uncover the potential that lies within!

Arbitrum's Yield Opportunities

Arbitrum presents a dynamic DeFi landscape teeming with yield prospects - if you know where to look.

Despite the Airdrop farmers leaving the chain, Total Value Locked (TVL) continues to expand, driven by high-quality protocols building on Arbitrum.

As one of my top picks in Arbitrum's DeFi ecosystem, Pendle stands out for its impressive yield offerings. With APYs ranging from 10% to a staggering 300% across various pools, it's no surprise that the protocol's TVL has been steadily climbing over recent months.

TVL: $77.61m 📈

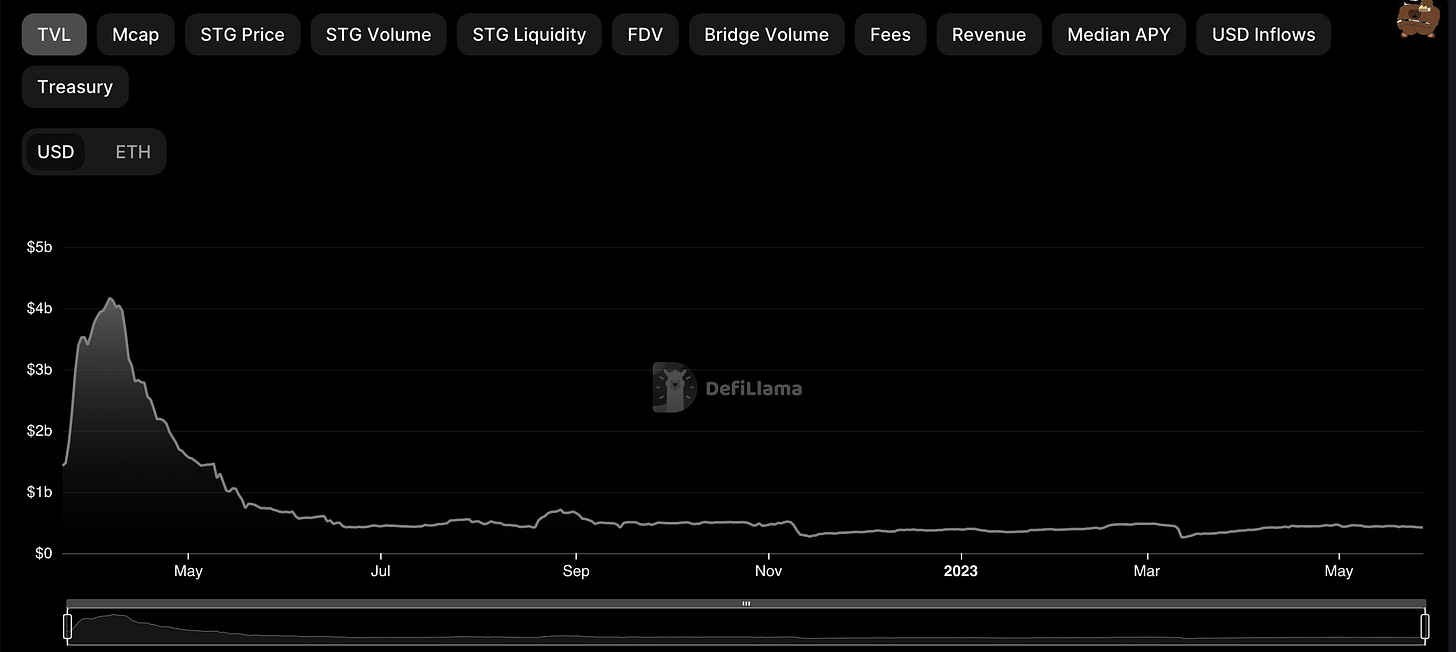

Stargate Finance

Stargate, an Omni chain bridge, provides enticing yields for several popular stablecoins. By staking your LP token, you farm STG tokens. Built on the LayerZero messaging protocol, Stargate offers more than just yield opportunities – by bridging, providing liquidity, and voting, you may be positioning yourself for a potential future airdrop.

TVL: $422.46m 📈

Gains Network

Gains Network is quickly carving out a reputation as one of my preferred DeFi protocols on Arbitrum, steadily cementing its place among the most recognized ones. Offering a wealth of opportunities, Gains Network allows you to stake GNS tokens, earn DAI trading fees, engage in leverage trading, or open a Gdai vault for a 4% APY. As a bonus, you'll also receive a portion of the fees from each trade on the platform, acting as the counterparty to all trades.

TVL: $56.74m 📈

GMX

Boasting continual growth and an expanding TVL on the Arbitrum network, GMX has emerged as the premier platform for leverage trading. By staking GMX or GLP tokens with GMX, you can earn yield on your assets, reinforcing its status as a key player in the DeFi landscape.

TVL: $638.98m 📈

Clearly, as evidenced by the charts, the TVL of protocols built on Arbitrum continues to ascend.

While there are other promising protocols like Radiant Capital, I haven't personally explored them and therefore, hesitate to recommend them.

What are the protocols you've recently engaged with on Arbitrum? I'd love to hear about your experiences - please share in the comments.

I hope you found this article enlightening and valuable. For more insights into DeFi and Crypto, please follow me on Twitter and subscribe to this newsletter. I post one to two articles per week, aiming to provide useful content to help you navigate the fascinating world of crypto. Thank you for your time and attention - I look forward to connecting with you further!

Support me:

📊 Trade on GMX with Arbitrum you can use this link for fee discount:

https://app.gmx.io/#/trade/?ref=yanneth_eth

🫡 Follow me on Twitter for NFT and DeFi insights: https://twitter.com/yanneth_eth

Disclaimer: Please note that I'm not a financial advisor. The content herein is provided for informational purposes only and should not be construed as financial advice.